The Federal Reserve is implementing a 'soft landing' strategy that prioritizes big businesses and financial interests over the working majority, in contrast to 2008 when the market crashed and bailouts favored large corporations at the expense of taxpayers. The current approach involves protecting these interests upfront, ensuring their stability during this economic downturn.

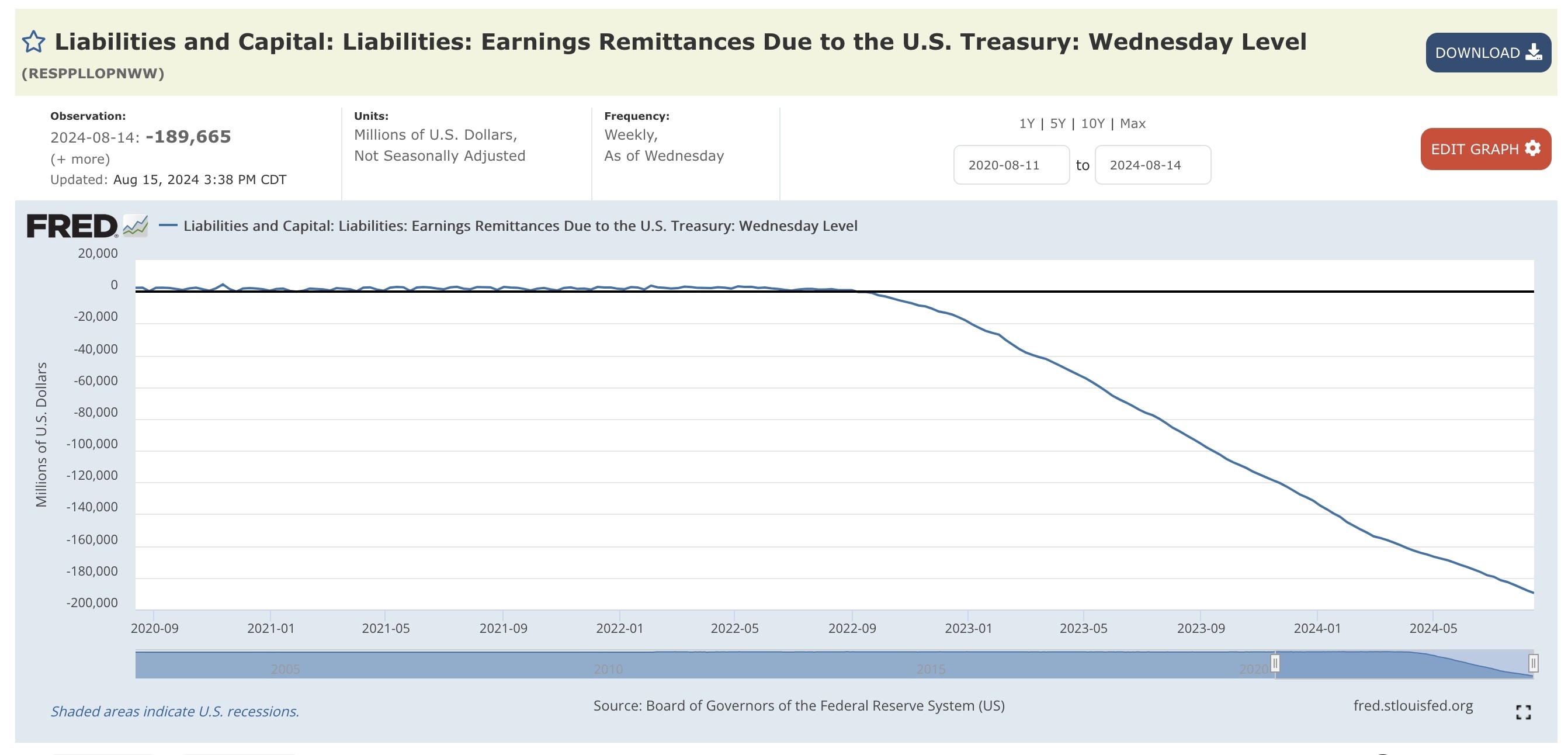

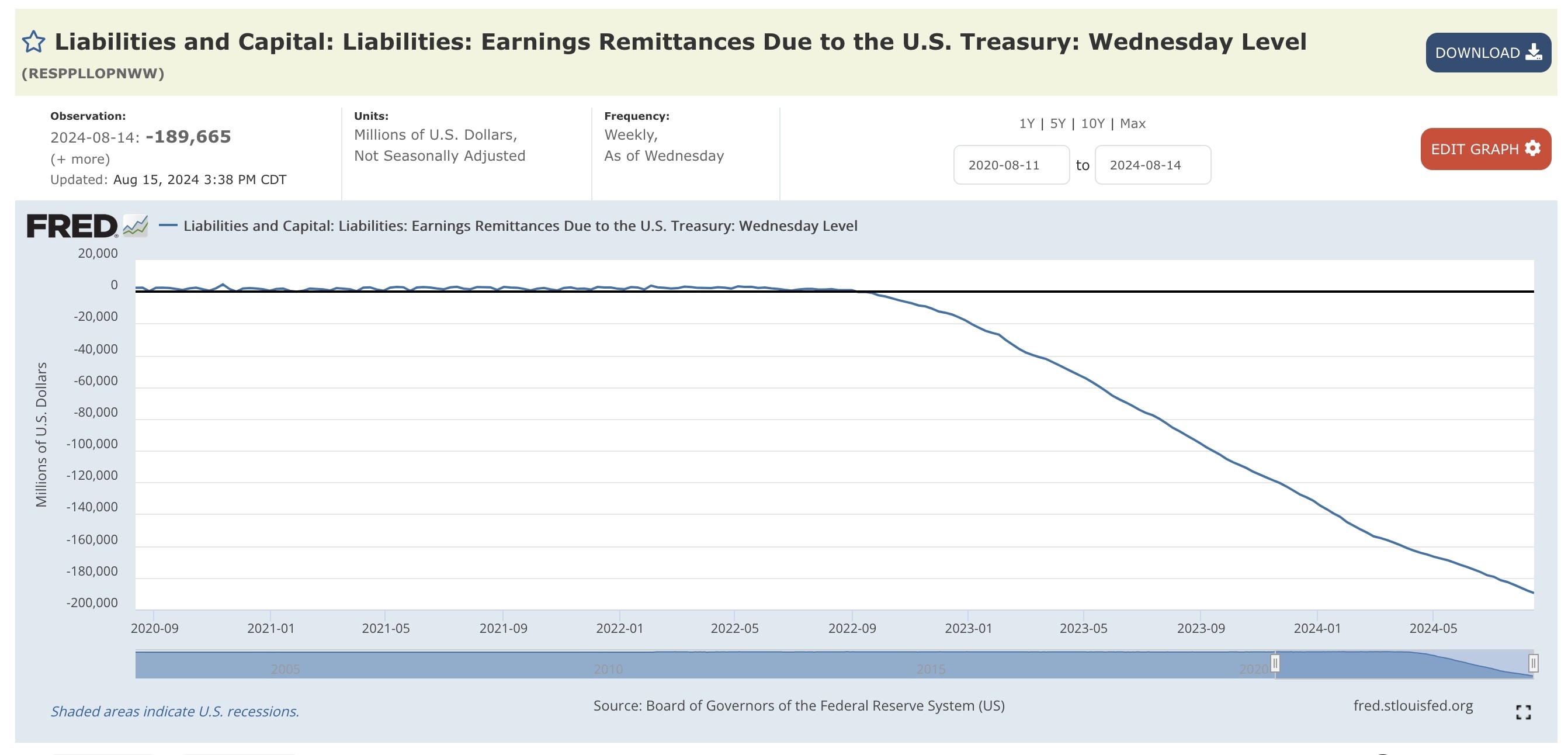

Fed “losses” are banks “gains” in terms of revenues, that ultimately become net income and turn into capital. The fed bought up overpriced bonds from financial institutions like Goldman Sachs, which wasn't a significant issue when interest rates were under their control between 2008 and 2022. However, the loss of credibility on inflation led to rate hikes, causing accumulated losses.

The Fed chairman has stated that small businesses will suffer while big businesses remain strong due to their cash reserves. This strategy comes at a significant cost for average individuals who may face unemployment and potential loss of homes as they bear the brunt of the economic fallout.

Rate hikes and macro-management of money markets are designed to make borrowing expensive, protect big banks, and reduce demand by pushing small and mid-cap stocks into bankruptcy. This approach seems poised to result in further consolidation and monopolization of capital.

This is all to backfill unrealized losses banks were carrying that were responsiblish for the bank runs we saw last summer too right?

I think so?