Once upon a time, there was a beautiful island called Degendaland. On the island lived little people ruled by a king, and the king had a formidable magician. Every time the king desired, he would ask the magician to make him pieces of money to spend, and the magician would immediately make them for the king.

The king really liked the power of the magician. With this power, he could pay for everything he wanted, without even having to make people give their pieces of money to be put in his coffers as tax.

Every time he felt like it, he could give pieces of money to the biscuit sellers in exchange for his favorite biscuits. The biscuit sellers from all the islands liked exchanging their biscuits for the king’s pieces of money. They would later exchange the money for the fish or the great houses of the island.

Every time he felt like it, the king could also play and practice his gambling skills. Sometimes he would play and win, that would make him quite happy, and he would talk about it all day long. Sometimes he would play and lose, he did not like that, but it wasn’t too big an issue, the magician would make up the missing pieces of money in his coffers.

Slowly, something bad started happening. The king was losing more and more often, and then one day, it was just every single time. The king had a consistent streak of bad luck, and he was losing every single game he played. Every day, he had to make the magician make him new pieces of money to settle his games. The king thought that surely he was about to win big any time now, especially because he now had a solid losing streak. So the king was betting more and more pieces of money each time, to recoup all his losses in one magnificent win. But every day was the same, and the king continued to lose.

Another worrying thing was that when the king settled the games, the people that received the pieces of money went on to spend them and the people that received those pieces went on to spend them too. Slowly, everyone had more and more pieces of money in their pockets to buy things. When it came time to bid for the biscuits and the houses of the little people, the little people had more pieces of money in their pockets to bid, so they bid more and more pieces of money, and the prices were always increasing, and people did not like that. Even the biscuit sellers from the other islands found out that the pieces of money they had got from selling biscuits during earlier trips to the island, could now buy them way fewer fish than before, and they also were getting angry.

The king thought about these issues and decided it was time to fix them once and for all: he called to consult an accountant about how to fix his losing streak.

The envoys of the king spread the word, traveled far, found a very powerful shaman accountant, and they brought him to the court.

The accountant started by setting up his stage for the divination ritual. There were cosmogonic symbols representing the life of the island: the coffers of the king, the expenses of the little people, the flow of the pieces of money, and even all sorts of mathematical symbols.

After the incantations were spelled, the incense was strong, and the possession was over, the shaman accountant announced his findings.

He explained that everything we do in our world has an impact on the metaphysical world, and everything the metaphysical beings do, also has an impact on our world. The culprit of the problems of the kingdom was a being of the metaphysical world that had grown too much, it was now trying to wreak havoc on the island, and its name was Deficit!

In our world, the Deficit being was linked to the coffers of the king. The flow of the pieces of money in and out of the coffers is what gives it its substance. The more the difference between the flows of the coffers grew, the more that being became a powerful and evil beast.

Unfortunately, he said, slaying the beast is a tricky task because, as a being of the metaphysical world, it would just re-manifest itself from its ashes at the first opportunity.

The solution would be to put a leash on the beast to reign in it so that it did not transform from a docile and useful pet into a great beast of chaos.

For that purpose, the shaman accountant took out a few blessed belts from his bag and offered them to the king and his servants. By wearing a belt and tightening it, they would be putting the beast on a leash and reining in it.

The king was not impressed. Not only the accountant was not addressing the main issue: the losing streak, but he was also coming up with some nonsense about chaotic coffer beings and leashing up their belts.

Nevertheless, the king ordered some of his servants to try the belts to see how they fit. After being offered their belts, the servants came up with very bright ideas about how to deal with the problem of the flow of pieces of money in the coffers.

The solution would be to ask the little people for their contribution in the sacred battle against the beast.

They would contribute some pieces of money whenever they got any pieces of money from trade. For example, when someone received pieces of money after selling fish, that person would contribute some of it to help defeat the beast.

They would also contribute pieces of money whenever they spent money to buy things. For example, the little people buying houses would give a great blow to the beast by contributing to the coffers some percentage of the money of the sale.

Last but not least, the little people would continuously batter the beast by also regularly contributing pieces of money for things they owned, like their houses, even though they had already contributed pieces of money to make the houses theirs.

This innovative system of contribution of pieces of money by the little people, with the goal of defeating the beast of Deficit, was greatly appreciated, and the servants were congratulated for their wisdom.

The accountant on the other hand, was not congratulated. He said that if the belts were not worn, adding the generous contribution of the little people to the coffers would only delay the chaos of the beast, like duct tape on a rupturing dam.

The beast can grow unnoticed, larger and stronger, and only when it strikes can everyone feel its blow.

Even if the losing streak were fixed, what would happen the next time it came back? What would happen if the beast stroke hard and the biscuit sellers realize the pieces of money they have accumulated over years and years were suddenly almost worthless? What would happen if the little people had more and more trouble affording their fish and their houses?

The accountant was hushed away. If the losing streak continued, and the magician had to create a lot of pieces of money, they could just make the little people of Degendaland contribute even more of their pieces of money to the coffers, and this way, they would rein in the beast once more.

They could not make the biscuit sellers on the other islands contribute to the coffers, though, so those pieces of money would make the beast strike if they ever came back to the island. What they would do instead is tell those biscuit sellers to deal with it: prices had increased, and they need more pieces of money to buy the same things. It wouldn’t be too much of an issue because there were not a lot of pieces of money outside the island in any case.

And what if some day the magician had to create even more pieces of money? The reply was that there was no need to keep scaremongering with the same metaphysical dangers over and over! Of course, they could again just increase the contributions of the little people and be done with it!

This was the plan, and this was the world, and the world stayed like that until…

One day, in some far corner of the world, on another island, in another story, someone discovered the spice.

The spice was said to be nuggets of the sun left in the world.

When you put the spice in the fields, the crop would grow plenty and strong.

When you put the spice in the night fire, it would light up all night and day.

Incredibly, when you put the spice in the forges they would heat up hot as the sun, and then you could drop in some sand to make glass, add some other dirt to make metal, and if you added some spice again to the metal, it became almost alive! It could now move and make you more things, faster and cheaper than you could ever imagine!

Everywhere you put it, the spice was truly magnificent, and it spread like wildfire across the world.

It really was the spice of life itself!

Like everyone, the king of Degendaland also wanted the spice, he wanted lots of it.

One day, in a new world, on another island, in another story, the king of Degendaland was able to convince everyone that he was rich, he had a lot of pieces of money and that everyone should trade the spice using his pieces of money only.

And everyone agreed!

Thus, the spice-money was born and lots of ships full of spice-money were loaned generously to the biscuit sellers on the other islands as debt.

The biscuit sellers liked the system. In return for their future biscuits they could borrow pieces of money from the King and exchange them for the spice or, just as easily, for products from the whole world.

The magician liked the system. He could continue practicing his skills in ever more artful ways.

The king also liked the system. He now had access to any biscuits in the world, and could continue practicing his gambling skills as much as he wanted.

The shaman accountant, though, he did not like the system. Every year, during his shamanic rituals, he could see the beast grow bigger and stronger, tensing, ready to unleash chaos on all those who hold the pieces of money. Every year, ever bigger amounts of pieces of money were shipped to the other islands. Every year, he kept asking himself: what will happen when it all comes back ?

The beast of the coffers will eat, its enormous, unleashed and ready for the onslaught.

You can open your eyes now, my friend. Tell me, do you remember how to make biscuits?

I hope you enjoyed this episode, here is the previous one if you missed it:

Chronicles of Degendaland - The ships of spice money are empty

You can also checkout my work and other networks

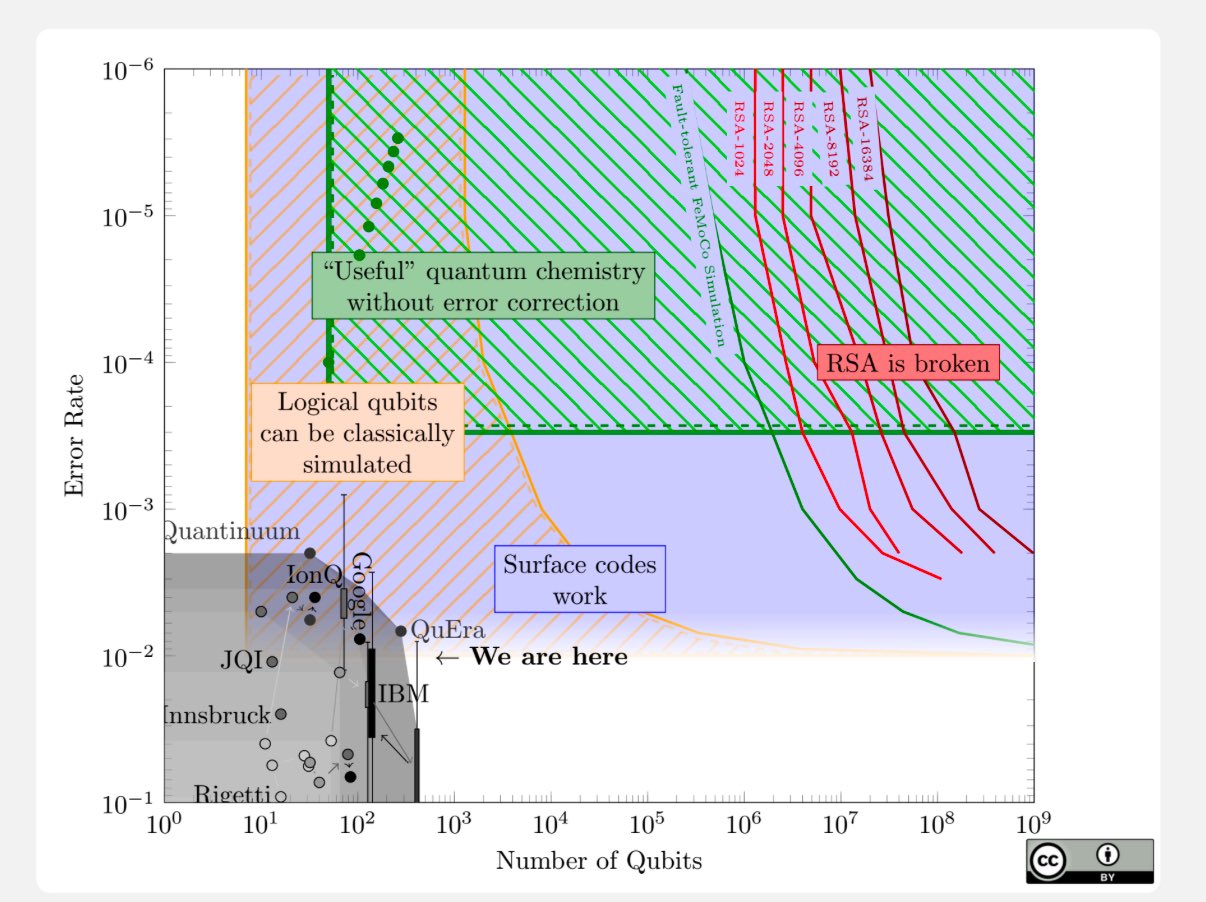

I don't think it will happen either, the community too much opposed.

First there are people that don't take the time to read about it and think it's about changing from RandomX mining to staking. Then there are people like me that do not want to rely on another chain for the security of Monero.

It's still good to discuss it openly. This way, we can get to a better solution and the community can decide in what way this PoS finality layer can be a contingency plan or not.