The complete opposite of what we need is a pretty good summary of Donald Trump

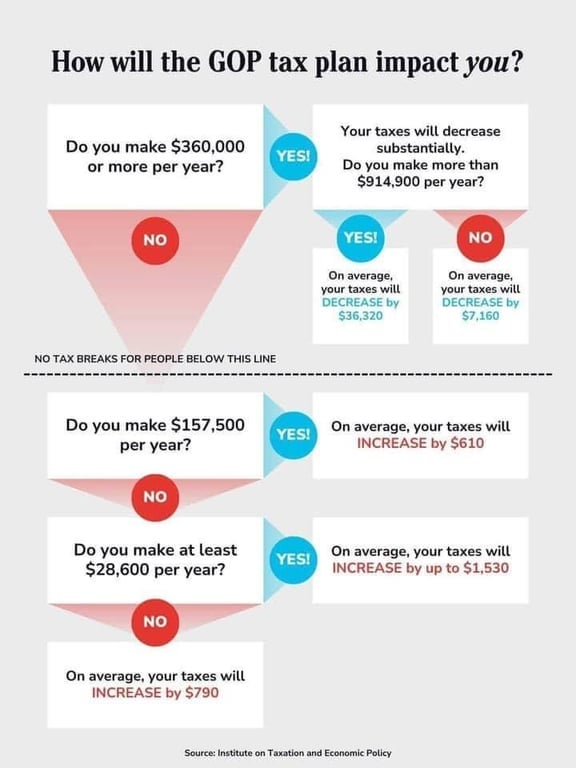

IMAGINE GIVING A FUCK ABOUT $36K WHEN YOU MAKE NEARLY $1 MILLION / YR!!!

America’s largest, consistently profitable corporations saw their effective tax rates fall from an average of 22.0 percent to an average of 12.8 percent after the Trump tax law went into effect in 2018.

The 296 largest and consistently profitable U.S. corporations in this study paid $240 billion less in taxes from 2018 to 2021 than if they had continued to pay the effective rates they’d paid before the Trump tax law.

While profits for the largest, continuously profitable U.S. corporations rose by 44 percent after passage of the Trump tax law, their federal tax bills dropped by 16 percent.

The number of these corporations paying tax rates of less than 10 percent increased from 56 to 95 after the Trump tax law went into effect.

Many of the largest and most well-known corporations in the country — including Walmart, Verizon, Disney, and Meta — had the largest tax reductions after the Trump tax law went into effect.

https://itep.org/corporate-taxes-before-and-after-the-trump-tax-law/

A tax increase is never fine and Trump is only gonna use it to fund the rich.

However there will be a tax increase if the US ever get’s social security.

making 30 k a year and having to pay even 1600 in taxes

That's like 5.3%, could that be real? That would be ridiculously low. I just checked and with that same income I'd be paying 2480 in Germany, or 8.3%, and that's in taxes alone. After social insurances and health insurance the total deduction would be 6450 or 21.5% total.

I can’t say anything about the validity of the infographic but it says “increase up to” so it’s relative not absolute. So without knowing the current taxation it would be hard to say that tax is low, unless you think the increase is too low. Or am I missing something?

Enshittification

What is enshittification?

The phenomenon of online platforms gradually degrading the quality of their services, often by promoting advertisements and sponsored content, in order to increase profits. (Cory Doctorow, 2022, extracted from Wikitionary) source

The lifecycle of Big Internet

We discuss how predatory big tech platforms live and die by luring people in and then decaying for profit.

Embrace, extend and extinguish

We also discuss how naturally open technologies like the Fediverse can be susceptible to corporate takeovers, rugpulls and subsequent enshittification.