1373

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 26 Nov 2023

1373 points (94.5% liked)

A Boring Dystopia

9727 readers

218 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 1 year ago

MODERATORS

Everything else aside, social security is not going to run out in 10 years, all the doomsday is if we do NOTHING, but we never do nothing on social security. It's not going to end or "go bankrupt", this is all fear mongering BS that doesn't stand up to the smallest dose of objective reality.

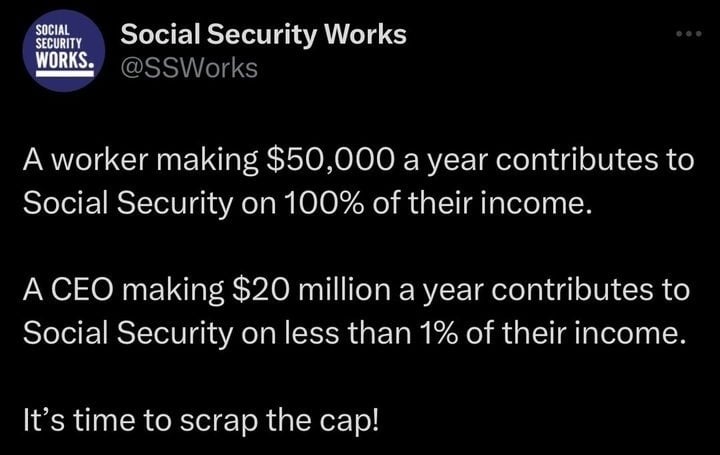

To make SS solvent all they need to do is make higher income earners contribute on the same scale they make lower income earners pay already.

If people making above 140,000ish had to keep contributing at the same rate as everyone UNDER that number does, there would be no issue at all. But a billionaire pays as much into SS as someone making 140k a year, probably LESS because of the Social Security payroll tax income limit.

Tax the rich already!

Eat them, but ok.

I'm good with either.

Libs going to lib

This never made sense to me. You get out of Social Security more or less what you put into it (with lower income earners actually getting a bit more, proportionately speaking). If you remove the cap, people will be paying more into it now and pumping the fund up. Eventually, we just hit the same problems when those high income earners eventually withdraw, since they'll be pulling that much more, as well.

I get the "tax the rich" idea, but Social Security isn't a tax, at least not in the same way as everything else. It's a retirement fund with mandatory contributions.

If you look into bend points, you will see that the first amount you contribute gets you a significant return later for your SS check, but as you contribute more, the slope of the size of the SS check flattens. After the second bend point, adding more into SS doesn't get you a much larger check.

The reason the rich wouldn't want to further contribute then, is because at that point, their contributions are getting a very poor return, and they would feel they could do better on their own. Since it isn't a tax, they would argue (correctly) that it is a waste of their money compared to investing themselves.