268

Bank of America Reverses Its Pledge Not to Finance Fossil Fuels

(www.nytimes.com)

Discussion of climate, how it is changing, activism around that, the politics, and the energy systems change we need in order to stabilize things.

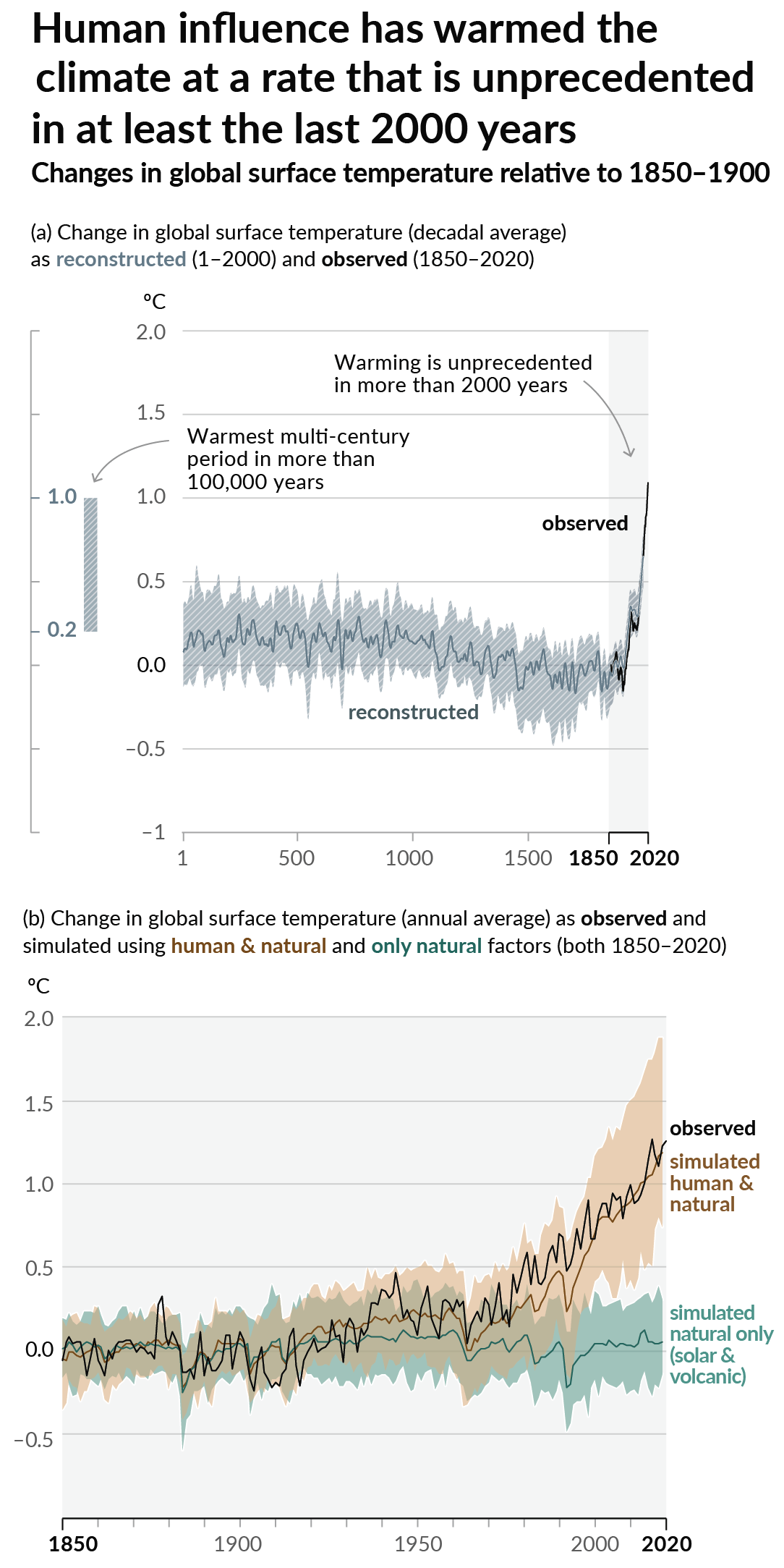

As a starting point, the burning of fossil fuels, and to a lesser extent deforestation and release of methane are responsible for the warming in recent decades:

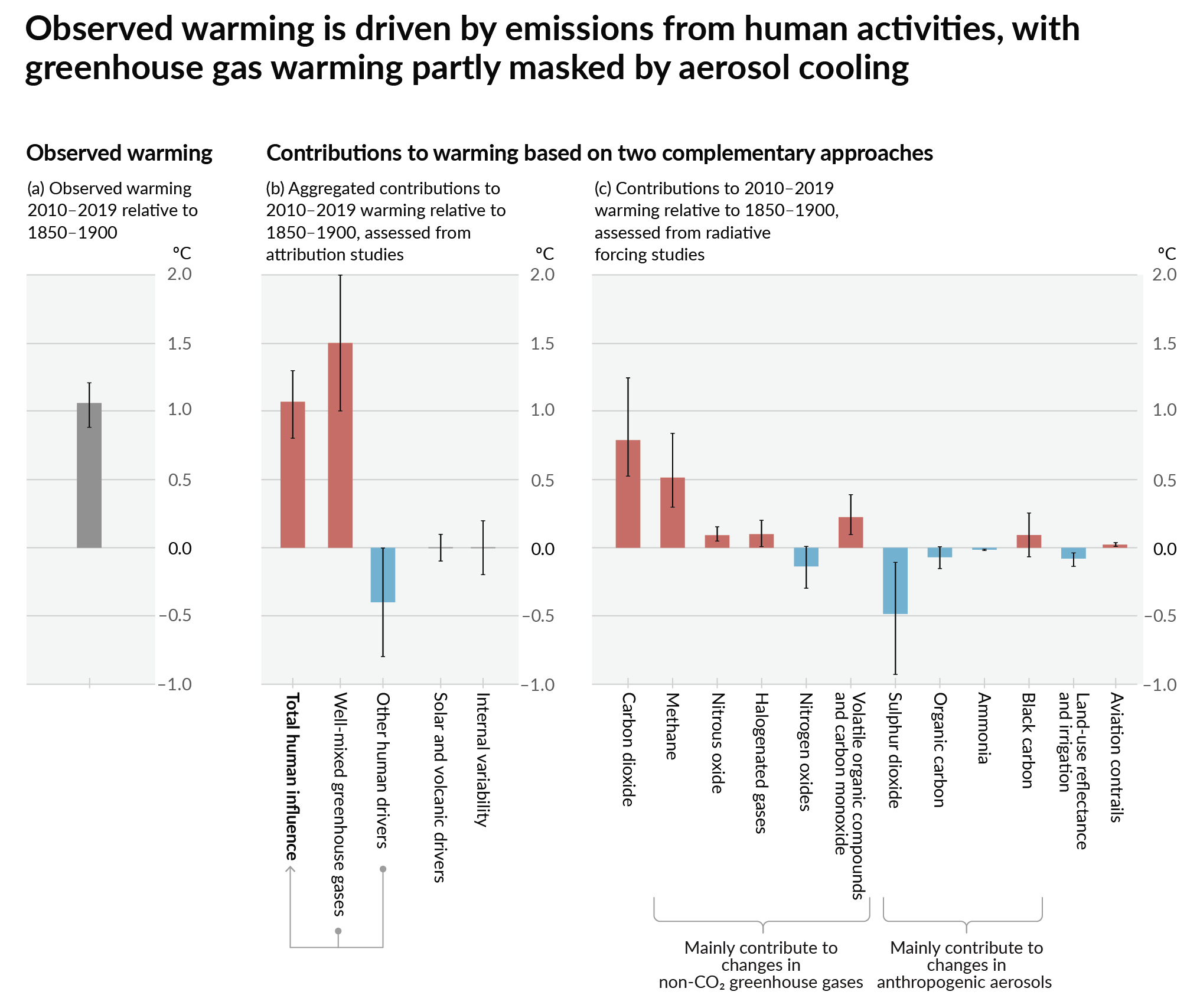

How much each change to the atmosphere has warmed the world:

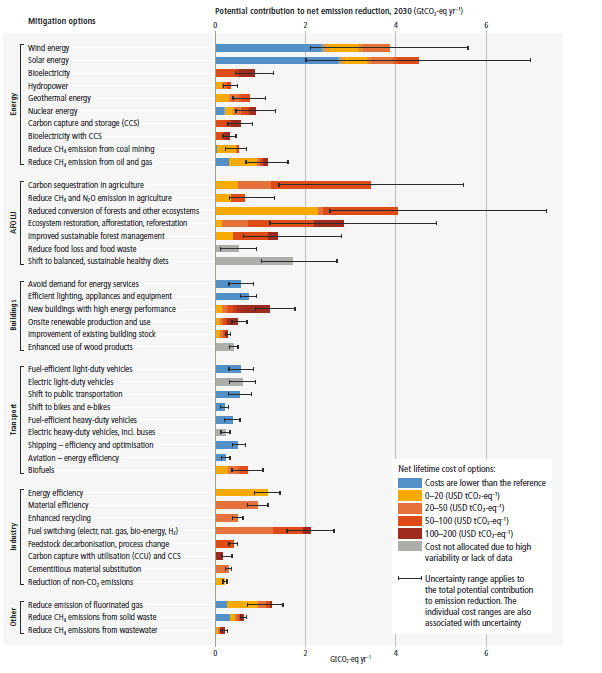

Recommended actions to cut greenhouse gas emissions in the near future:

Anti-science, inactivism, and unsupported conspiracy theories are not ok here.

Honest answer? I have one of their CC that gives 3% on all online shopping/purchasing. Plus BoA has a program for all card members to get free entrance on the first weekend of each month to select museums.

Between both of those and paying it off each month, I like to think that I'm actually costing BoA a little bit of money (and getting some money from bank-hands into museum-hands)

The AMEX Blue Everyday card offers the same 3% cash back for online purchases with no yearly fee, along with their reputation for excellent customer service. Bank of America, on the other hand, has a reputation for atrocious customer service.

I will consider this. Is Amex a better organization than BoA? They both kinda seem like banking behemoths to me. Cust supp is nice, but it's not something I use often.

I mean, environmentally, probably not substantially (Though BofA is known for being one of the worst offenders). But as far as credit card companies go, they seem like one of the better ones from a customer perspective.

A Debit card from a Credit Union would likely be the most environmental option, but seeing as in the US, Debit cards do not have the protections they do in the EU, I believe we're stuck with using credit cards from companies that don't give a crap about carbon emissions.

Meanwhile, they invest in the worst markets. If you use a local credit union, your money goes into your community, with some you can vote on banking decisions (I use BECU), and all credit union ATMs are in network, so your fees get refunded.

I agree, I even have a savings account at a local CU. Tbh their dividends on that account have been disappointing. I may look into CDs through the same institution.

Considering I only have a CC through BoA, and I've explained how I believe I'm a net negative for them, how am I contributing to their investments? Perhaps they're selling my data? Or perhaps I'm boosting their numbers by simply having an account? Honest question.

Downvotes for answering D: I'm not opposed to closing the account. But the museums alone could be costing boa 10-30/month, assuming each admission is paid out close to face value. Surely this helps the community more than a CU, and costs boa more than they could possibly make off me (since I pay no interest, and hold no checking/savings there).

CMV?