The Federal Reserve is implementing a 'soft landing' strategy that prioritizes big businesses and financial interests over the working majority, in contrast to 2008 when the market crashed and bailouts favored large corporations at the expense of taxpayers. The current approach involves protecting these interests upfront, ensuring their stability during this economic downturn.

Fed “losses” are banks “gains” in terms of revenues, that ultimately become net income and turn into capital. The fed bought up overpriced bonds from financial institutions like Goldman Sachs, which wasn't a significant issue when interest rates were under their control between 2008 and 2022. However, the loss of credibility on inflation led to rate hikes, causing accumulated losses.

The Fed chairman has stated that small businesses will suffer while big businesses remain strong due to their cash reserves. This strategy comes at a significant cost for average individuals who may face unemployment and potential loss of homes as they bear the brunt of the economic fallout.

Rate hikes and macro-management of money markets are designed to make borrowing expensive, protect big banks, and reduce demand by pushing small and mid-cap stocks into bankruptcy. This approach seems poised to result in further consolidation and monopolization of capital.

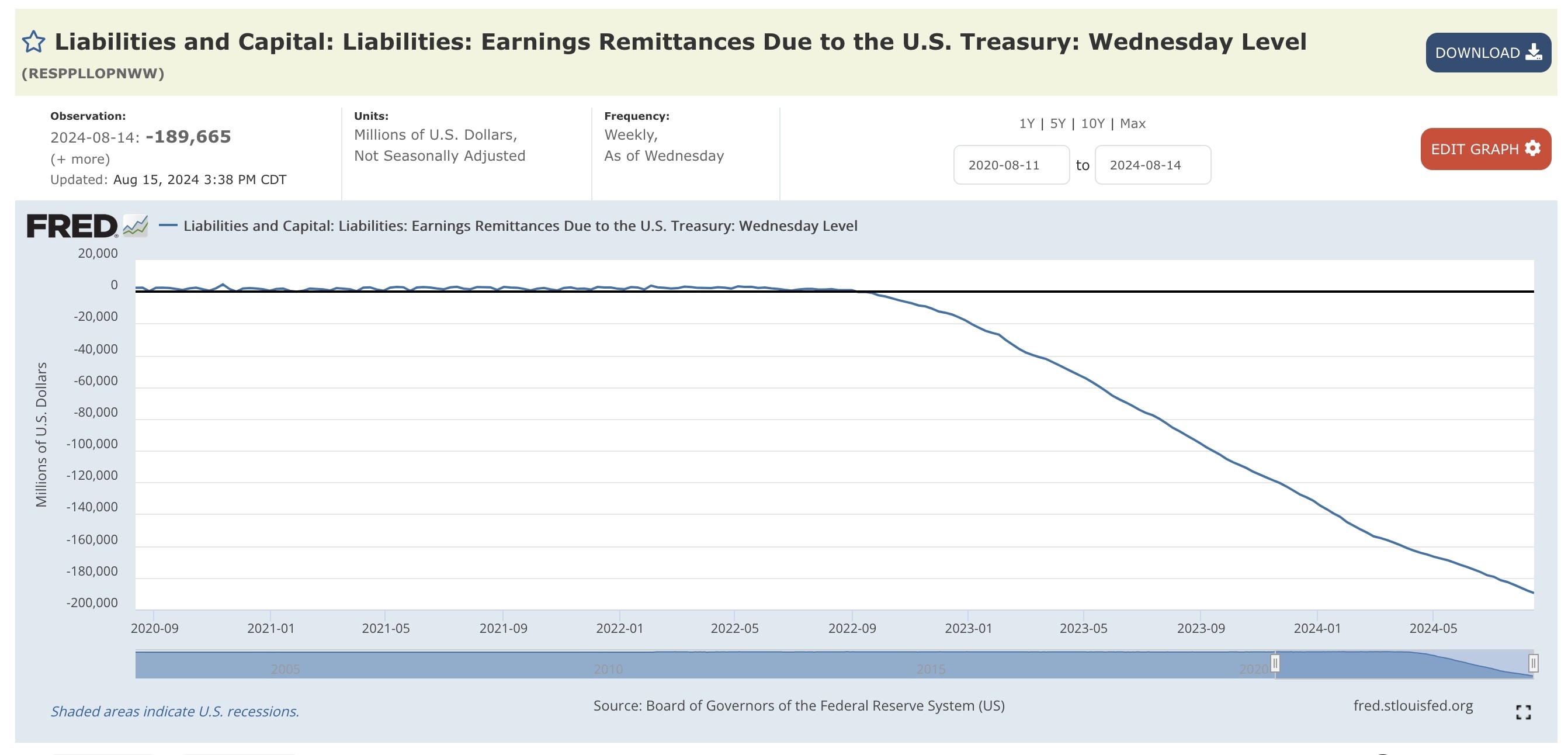

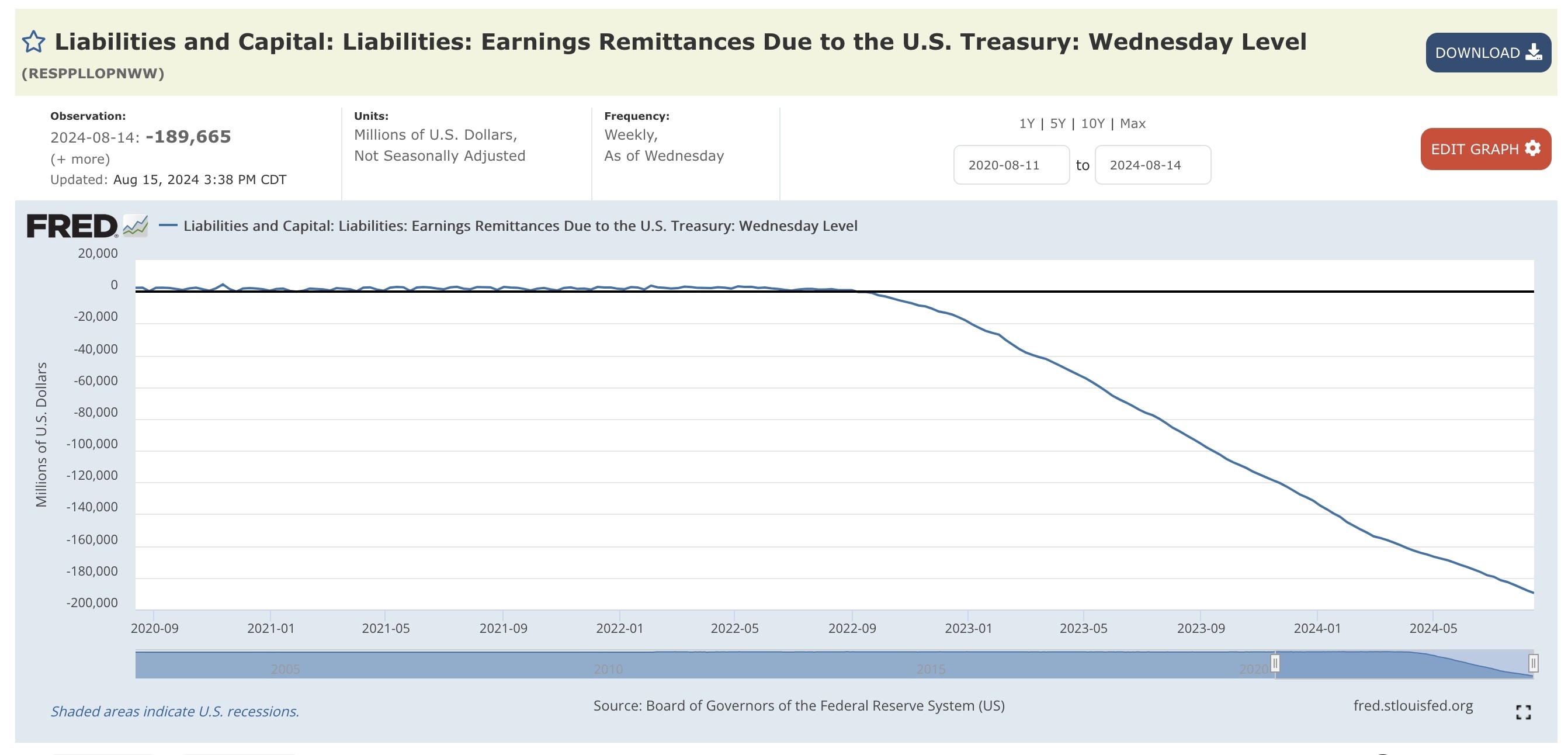

A bit longer explanation of the graph. The US Treasury is effectively the owner of the Federal Reserve’s entire balance sheet. Any profit or loss resulting from the Fed’s monetary policy actions flows back to the Treasury.

For a long time, the Fed’s income from holding Treasury debt and fees from financial institutions outweighed its expenses (like interest paid on reserves and operational costs).

However, when the Fed raised interest rates on reserves from near 0% to around 5% in 2021-2022, its expenses surged. This was because the Fed had trillions of dollars in reserve liabilities after years of Quantitative Easing (QE) – buying Treasury bonds and Mortgage-Backed Securities (MBS) to stimulate the economy.

Reserves are liabilities with variable interest rates, so the Fed’s expenses rose immediately. Meanwhile, its assets (mainly Treasury securities and MBS) pay fixed interest, so their income didn’t increase.

Here’s the problem: the value of the Fed’s assets fell when it raised interest rates. This normally wouldn’t be a major issue, as the Fed could just hold those assets until maturity and receive their full value. However, the Fed has been shrinking its balance sheet via Quantitative Tightening (QT) - selling these securities back into the market at a loss.

The overall impact is that the non-government sector now has more claims on the government than before. Essentially, the government spent money into the economy, exchanged that spending for Treasury bonds, the Fed bought those bonds, and is now selling them back at a loss

The key takeaway is that the Fed’s decisions to raise interest rates and conduct QT have increased the government’s overall interest expenses. This leaves less room for non-inflationary public spending on vital areas like healthcare, education, infrastructure, and so on.

This is all to backfill unrealized losses banks were carrying that were responsiblish for the bank runs we saw last summer too right?

I think so?