I posted a tad about costs with my son undergoing cancer treatment:

TL;DR: mine is $660/month for health, $42/month for dental

Most folks in the US aren’t aware of how much they pay for health insurance. I live in California, where law requires full time employees (>30 hrs a week, >130 hrs month) be provided some amount of health insurance. The type of coverage varies not just from job to job, but also within the same job the employee must often choose their own plan from several company selected options at varying price tiers and types/amount of coverage. Usually the employee only sees the amount of the monthly cost that THEY are responsible for, which is then automatically removed from their paycheck. What most folks are unaware of is that the employer is also paying some of the cost (which is the part that the law makes them do). The part that makes it extra frustrating to deal with an already broken and overly expensive system, is that the rate paid by employers is negotiated in bulk with the insurance providers. Larger employers (national corporations with hundreds of thousands of employees) are paying much less than an individual or small employer would. This is the one of the largest reasons becoming unemployed is so dangerous in the US. In addition to not having income for food or housing, people often forego health insurance due to the expense. If you lose (or leave) your job you’re eligible to keep your current insurance plan for 18-36 months with COBRA (Consolidated Omnibus Budget Reconciliation Act, which is such a ridiculous backronym that I had to google it just now). This is often the only time people realize the true cost of their insurance as the entirety of it is then passed on to them directly (at the employer negotiated rate) and it shows up as a new monthly bill.

I recently left my employer to start my own business and discovered that my true cost of insurance is ~$700/month ($660 Health/$42 Dental). Keep in mind, this doesn’t mean that I have zero medical bills should I actually visit a doctor or hospital. This is pretty good health insurance, but I still have to pay $5,000 out pocket (annually) before it kicks in at the full coverage amount. Since I had ear surgery earlier in the year and hit that limit, and wanted to be able to continue seeing the same doctors I had for already scheduled follow ups, I decided to keep the same insurance. That $5,000 isn’t the only expense that landed on my shoulders, there’s a bunch of rules that I honestly don’t fully understand and I’ve probably ended up paying somewhere between $7,500-$10,000 for the surgery I had (in addition to the monthly premium).

The main reason I keep paying insurance (in addition to the fact that you’ll now be charged a penalty on your taxes if you go uninsured for a month), is my fear that you mentioned in the original post. Having a car hit me while I’m walking down the street and ending up with a $50,000 visit to the emergency room is a very real possibility without health insurance. California recently limited ambulance rides to a maximum cost of $1,200, so that’s… good?

It is true that nobody pays the cartoonishly high bills that you see posted online. It is also true that we spend way more on healthcare than basically anyone else.

My company offers very good insurance. Anything "in network" is free after the first $3000 every year, and the monthly premium is around ~$330. Note that this is a company that intentionally offers very good health insurance so they can be less competitive when it comes to salary and time off. I'd say in a given year, I spend around $7,000.

But really, one of the biggest practical issues with our healthcare system is its opacity. Most people are unable to figure out what most things will cost them before they consent to care.

A lot of people simply don't because they can't. It's absurdly expensive because the system isn't designed for people to pay for it out of pocket. If someone doesn't have insurance, they'll either beg the hospital for mercy or ignore the medical debt because it doesn't count against your credit score. Even if they do have insurance, it often doesn't cover a portion of the cost, the insurance is extremely expensive, or both. The people with quality insurance through their employer have it good, but the system expects everyone to have that privilege.

Currently, nothing.

If your income is low enough, you can get free insurance through the government. In my experience, the regular doctor checkups and stuff is covered, along with prescriptions and any emergency room visits. The dental portion only covers the worst dentist in town, and vision is non existent.

It's not great, but medically necessary things are covered without copay or arguing with an insurance company to get it paid for. It's good enough that I've known people who purposely kept their income low to continue to qualify for the free insurance.

I have good insurance. I pay $20 per paycheck for my wife’s coverage. Our typical visit costs 20-35 depending. Our medications cost 10-20 per 3 month supply.

Most people don’t have insurance this good.

I pay $30 per doctor's visit and $40 if the visit is for a specialist. I also pay $0 for a yearly checkup and $0 for telehealth. For any hospital visits, I pay 20% of whatever the actual bill is after a $300 copay (basically a down payment), which came out to a total of $600 when I went to the ER. Lastly, my prescription drugs are capped at $10 per month for generics and $150 for some brand-name drugs.

I use a ton of healthcare and the costs have been super manageable, but affordability is going to vary wildly between people. A ton of insurance plans don't start working until you hit an out-of-pocket minimum of several thousand dollars, and others work like mine except with way higher copays.

Lastly, insurance often doesn't cover certain drugs or procedures. As someone with really good insurance with good customer service, it's still an issue every so often, and the solution is either to find an alternative, try to find a manufacturer's coupon and pay up, or suck it up and move on. There are insurance companies that use shady tactics to get them out of paying for certain expensive drugs that they're supposed to cover.

everything you've listed is what you pay at the point of service. are your premiums covered 100% by your employer, or what?

Back in 2007, I had just finished college and was traveling cross country to start a new job. I had to stop and get emergency surgery on the way there and ended up in the hospital for a few days. I ended up paying around $70,000 over the next few years and the hospital finally forgave the rest of the bill.

I quit even responding to them. After two or three years I'll get sued for a very small amount. It will be some radiologist who looked over a xray who has sold his debt to some bottom feeders. I wait until I'm served then I pay it. Within six months some other bottom feeder will serve me again for the same debt. When I go to court showing it was paid I can generally get my money back from the second bottom feeder. I've done this three times and got paid twice. The third time cost me nothing but time. Its long drawn out and stupid but its the shit sandwich we are forced to eat to live in the Home of the fee.

It really depends. Some people have insurance that limits their liability to $500 or whatever for hospital visits, but if so they probably are paying a lot out of each paycheck for that.

I have family coverage and this plan pays essentially zero towards anything, except pays 100% of the annual wellness visits to GYN, GP, and dermatologist, any vaccines considered preventative too. Then there is a "deductible " of 6,850 per person with a maximum of 8,000 a year, then it would then pay 80% of anything above that $8k until we paid $16k, then it would cover 100% of anything above that. So basically it really is "insurance" not healthcare.

Which would be ok except that the plan itself costs almost $7k a year in premiums. I am not getting that much value out of it. And that's not even the total, my employer is paying some too!

So most years this costs us in total maybe 8,000, the premiums plus a couple of visits and any drugs.

The only people winning in this system are the insurance companies, the one who owns our plan made revenue of $371 billion last year and a net PROFIT of $22 billion.

Oh and as you are asking about uninsured, I was for a long time, and you have to negotiate your own prices in that case, argue for a cash price. And hope nothing big happens. The mammogram cost almost $600 when I had to get a diagnostic one, colonoscopy $1,500. Childbirth, at home with midwife including all prenatal about $8k. Doctor visits between $80 and $200.

Firstly, thanks everyone for all the responses. I appreciate it, and I hope that some of you felt better after having a vent.

American friend predictably says there's a problem with "healthcare literacy" and that you just don't have to pay the bills and they probably won't chase it up. I don't beleive that at all.

I figured it might be interesting to share how much I pay for stuff up here in Scotland.

I have a decent well paying job so I pay some money to the NHS in taxes, specifically ~£2000 a year. I get antidepressants and doctors appointments completely free from that. Dental I don't get free because my income is too large, but it's only like £20 for most routine things. I have a free eye test booked next week, and I splurged £10 extra to get fancy 3D imaging stuff done.

I do require mental health treatment though, and the NHS doesn't cover that for autistic people (as a competence issue, rather than a policy choice). A session with a counsellor costs £45 per hour for me privately.

Honestly, the surprising thing to me isn't that you have an insurance system (Switzerland has a similar thing, iirc), it's just how inflated prices are compared to here.

American friend predictably says there’s a problem with “healthcare literacy” and that you just don’t have to pay the bills and they probably won’t chase it up. I don’t beleive that at all.

healthcare literacy is an understatement and i'm glad you quoted it, you literally have to be a full time lawyer reading through this shit with a career SPECIFICALLY in handling health insurance to be able to understand it. Outside of that you're literally just guessing that it'll work.

Maybe someday i or someone else can found a thing like "open healthcare" providing that information for free in a fully publicly accessible manner. Why it isn't legislated, i don't know.

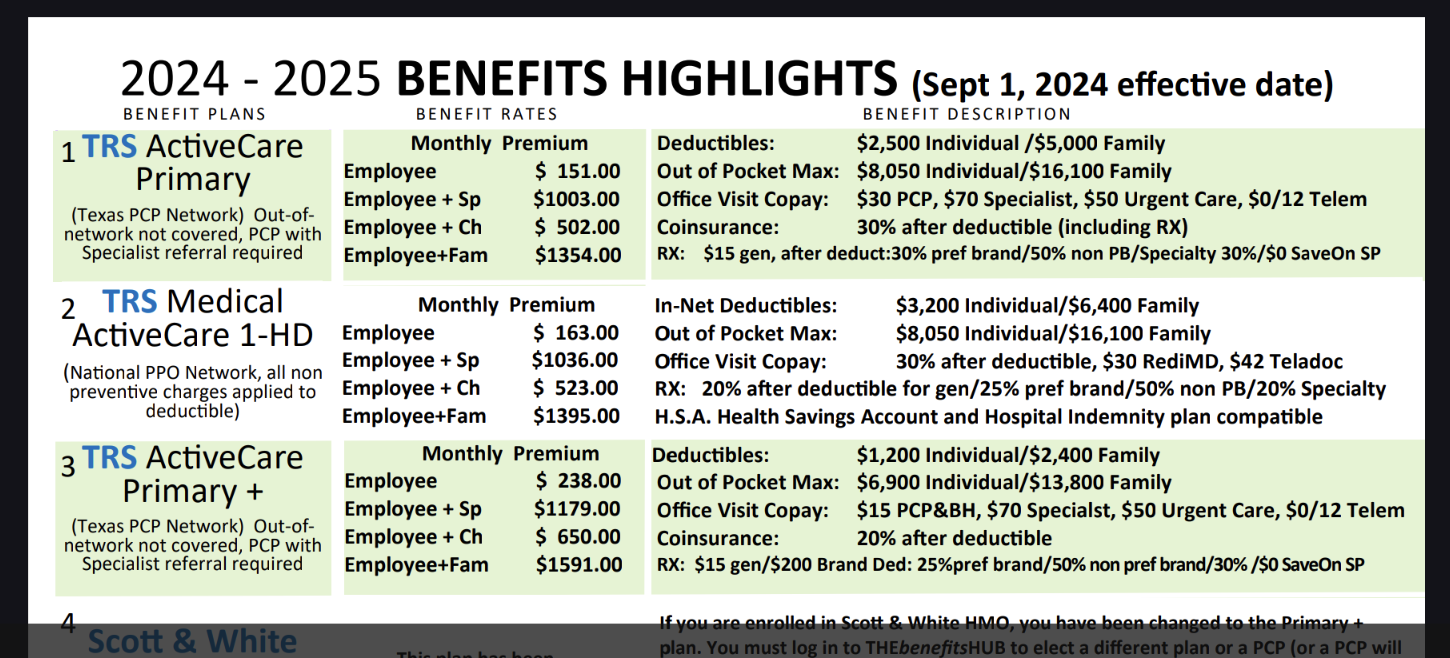

I work for a public school district. We're signing up for insurance now to begin sept 1. These are our available plans. I always take the HD (high deductible) plan because i contribute to an HSA (health savings account- pretax money that you put into an account. They send you a card and you can use that to pay med expenses.)

ETA- forgot to finish my thought- I may switch to the higher plan because i see it's only $75 per month more but saves $2k in deductible and $1100 out of pocket max. I'm considering a knee surgery this year, so i would likely meet those. This is an area where you have to pay your bill if you want to ever go back. I still owe $700 to the anesthesiologist for the other knee surgery 3 years ago. I will have to pay that to schedule another. For emergencies, hospitals are required to treat. My son without insurance had an emergency appendectomy 5 years ago and has never paid a dollar of the $5k he owes. They continue to send bills and he continues to throw them away. If he had another emergency, he could show up at the ER and they would treat him and the cycle would continue forever until he needed a scheduled procedure with that hospital system. Then they would likely require that he pay a certain amount upfront. My other son has obamacare. He pays $250/mo for it because he sees a weekly therapist that's $75 without insurance or $20 with insurance. It's all a very complex game of which is cheaper, what are you getting, how much are you willing to risk/commit, and do you expect to get sick or have an accident. My husband cannot add me to his insurance because i have access to it through my work. I was on his dental insurance and they dropped me because we couldn't find our marriage certificate from 30 years ago. 30 years of tax records showing we filed as married were not sufficient. It's really just their way of getting spouses and families off the plan. It's all a scam.

A lot.

How do you pay for car insurance or renters insurance? It's not too dissimilar to that.

Though, I've moved to a state that has deemed me poor enough to give me Medicaid so the taxpayers pay for mine weather I want it or not. It beats paying almost $800 because living with my mother disqualifies me from the affordable care act subsidy.

You essentially gamble a little bit. Most people get insurance through work (or they are part of a family plan). Generally, you'll have a few plans to choose from. If you are older, or have recurring issues, you might pick a plan that's a little more expensive, but covers more costs. If you are young and healthy, you might pick a cheap plan, essentially betting that you won't really need healthcare other than your yearly checkup and some vaccines.

The biggest thing with healthcare in the US is that it's very complex. Even if you have insurance that should cover something, it can be hard to find a doctor that's part of your insurance, so people often put off going to the doctor, which is part of the reason why costs are high. Teeth and eyes have separate insurance cause they are optional, apparently.

You basically have "premiums" that are your monthly payment. If you get your insurance through work, they cover a percentage of that; generally a pretty hefty amount of it. They usually don't outright tell you what percentage, though, so many people think insurance is cheap, and get a rude awakening when they lose a job, and suddenly can't afford $1000 a month when they used to be paying $100. Those premiums are taken out of your paycheck pre-tax, too, which gives you even more of a benefit if you have a job.

Depending on the "style" of the plans, they cover things differently. They all (I think) cover "preventative care" completely, which includes your yearly checkup, vaccines, and birth control for women. After that, some plans have "co-pays", which are set costs for a few things, like $25 for a normal doctors visit, $50 for a specialist, $100 for an emergency room visit. Some just cover a percentage of those costs, and some don't pay anything until you hit a limit (the deductible). Finally, there's an "out of pocket" limit. That's most you'll have to pay in a year, after which point the insurance covers everything.

All together, I pay less than $1000 a year for healthcare, but if I got really sick, and needed a bunch of expensive healthcare, I would quickly hit my out of pocket maximum, which I think is like $6,000. I could cover that, but many people cannot cover an expense like that on short notice.

The number on bills is very misleading. The hospitals know that insurance will negotiate down, so they start high, and then after the negotiations, insurance will pay some or all of the remainder. If you don't have insurance, you typically don't pay that whole number on the bill, either, cause the hospitals recognize that they dont have to adjust it up for the negotiation. You can still negotiate on your own, though.

It varies a lot for people, and the bills you actually pay depend on a lot of things. It’s complicated here.

I would say I’m the average “I have healthcare through work” person. But that’s not average for the population (many people have no healthcare).

I pay about $600 a month for a plan that lets me go to any doctor (called a ppo). If I wanted a cheaper monthly bill, I could get on board with the plan where you have to go to the doctors and facilities that are “in the insurers network”. I’ve had problems with these plans as they’ve become more and more run by the insurers than actual doctors - leading to shoddy care. So $600 a month for my family it is.

I did require major surgery about 10 years ago. I was in the hospital for a month and had a million office visits. The grand total “bill” was just over a half million dollars. My portion of that was about $10,000. It was crazy to look at the itemized bill though. Two Advils cost like $50. An X-ray? Like $1000. But that’s like this this fucky-fuck game insurers and providers play with each other. Sometimes people are flat broke, and the hospitals still have to care for them if they wander into the ER - and they get paid nothing. It’s a weird system.

If you don’t have health insurance-you’re kind of in trouble. Interestingly, those $1000 X-rays become $200 if you’re uninsured. Definitely more manageable-but you’d be screwed if you required major surgery. You’d be bankrupt.

Basically it’s very American-it works great for people doing well in life - screw everyone else less fortunate- get a job…

nobody actually pays those bills. They're just some elaborate dance between insurance companies and hospitals.

Sometimes there is an elaborate dance between the two on pricing. Sometimes the insurance company dances on its own to determine why the service is not covered.

If you don't have insurance, the cost is lower

Depends what you mean by cost. insurance is always out to make money, that means paying less, and negotiating lower prices with providers. However, there are some situations where it benefits both the service provider and the insurance provider to inflate the initial price, and negotiate a steep “discount” to a final price (a portion of which the patient pays) that is higher than the non-insurance price. But I don’t remember the exact details, and I may be conflating this with some other healthcare industry scheme.

or removed entirely. Supposedly.

If a hospital is nonprofit, I believe they are required to have a (self determined) charity care policy that they must follow. If you make below a certain amount, you can apply for relief, but that also applies for to after-insurance costs, not just no-insurance costs. For-profit hospitals will rake you over the coals and send collections after you. Part of the problem with charity care, is that you may have to ask for it, and few people know enough about it to do so. And you may have to ask for it in the right way. If you aren’t specific enough, they may offer you “financial assistance” which is just a payment plan. Then they’ll treat you the same as a for-profit hospital would.

If you’re interested in a deeper dive, the Arm and a Leg podcast is a great show about healthcare costs in the US.

Ask Lemmy

A Fediverse community for open-ended, thought provoking questions

Rules: (interactive)

1) Be nice and; have fun

Doxxing, trolling, sealioning, racism, and toxicity are not welcomed in AskLemmy. Remember what your mother said: if you can't say something nice, don't say anything at all. In addition, the site-wide Lemmy.world terms of service also apply here. Please familiarize yourself with them

2) All posts must end with a '?'

This is sort of like Jeopardy. Please phrase all post titles in the form of a proper question ending with ?

3) No spam

Please do not flood the community with nonsense. Actual suspected spammers will be banned on site. No astroturfing.

4) NSFW is okay, within reason

Just remember to tag posts with either a content warning or a [NSFW] tag. Overtly sexual posts are not allowed, please direct them to either !asklemmyafterdark@lemmy.world or !asklemmynsfw@lemmynsfw.com.

NSFW comments should be restricted to posts tagged [NSFW].

5) This is not a support community.

It is not a place for 'how do I?', type questions.

If you have any questions regarding the site itself or would like to report a community, please direct them to Lemmy.world Support or email info@lemmy.world. For other questions check our partnered communities list, or use the search function.

6) No US Politics.

Please don't post about current US Politics. If you need to do this, try !politicaldiscussion@lemmy.world or !askusa@discuss.online

Reminder: The terms of service apply here too.

Partnered Communities:

Logo design credit goes to: tubbadu