26

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 05 Sep 2023

26 points (96.4% liked)

US News

2249 readers

44 users here now

News from within the empire - From a leftist perspective

founded 6 years ago

MODERATORS

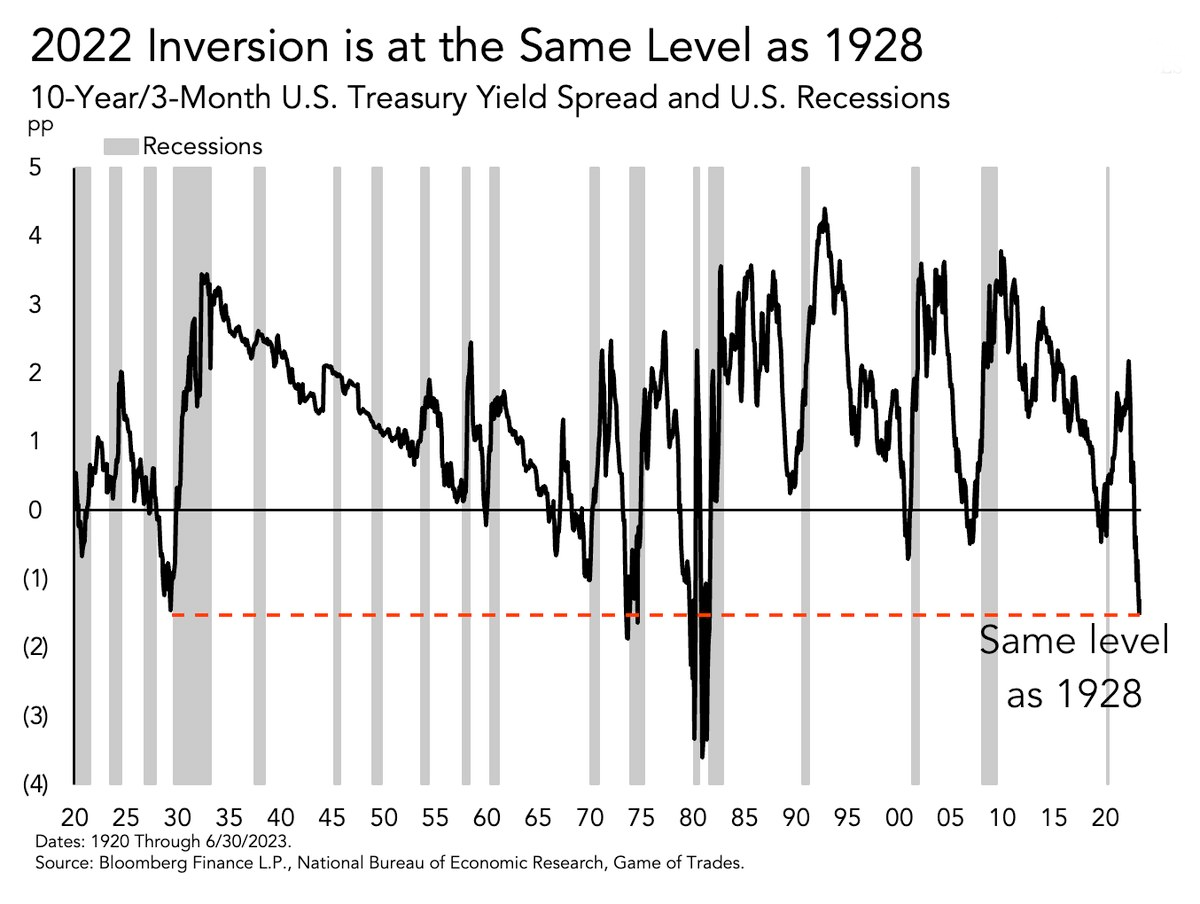

It’s possible. Since all bonds yields are also proportional to inflation, it just means inflation is high. That in itself can be a good thing for the economy (demand driven inflation) or a bad thing (supply driven inflation). The curve inversion compares bonds against each other so it negates the effects of inflation.

But keep in mind that what’s good for the economy may not necessarily be good for the people. Demand driven inflation also means a higher rate of capital accumulation, and a decrease in the living standards of the working class. It’s also something that the federal reserve implicitly said they were trying to do for years. (Fuck J pow)

The economic situation we want is actually supply driven deflation, where prices become cheaper because goods cost less to produce. This is the situation where it’s the most detrimental to the investor class. That has its own problems such as debt being harder to pay off. But that can be fixed with negative interest rates.