If anyone’s interested as to why this is, it’s because interest rates are proportional to risk.

Under normal circumstances, investors of bonds are exposed to higher risk when they buy a longer maturity bond. So they will get a higher interest rate. IE: 10 yr bonds will have a higher yield than 2 yr bonds.

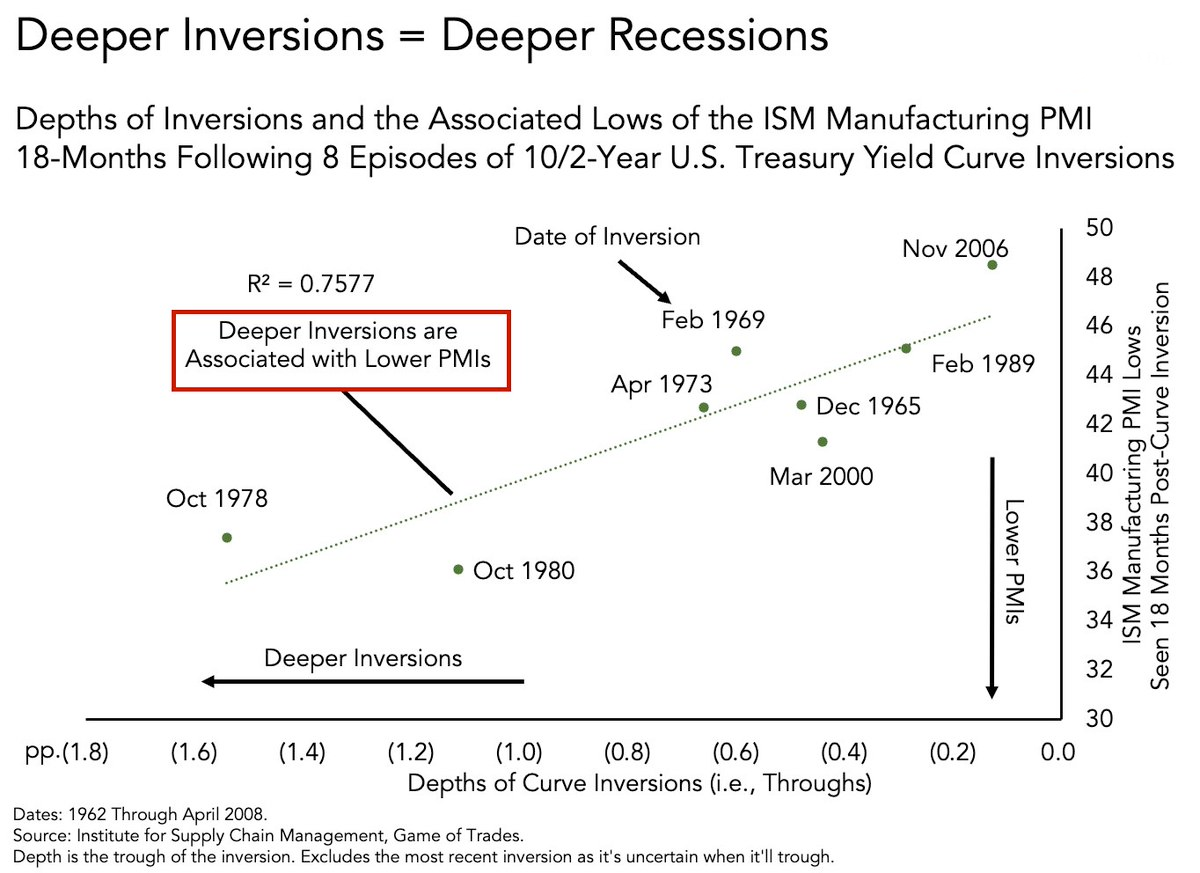

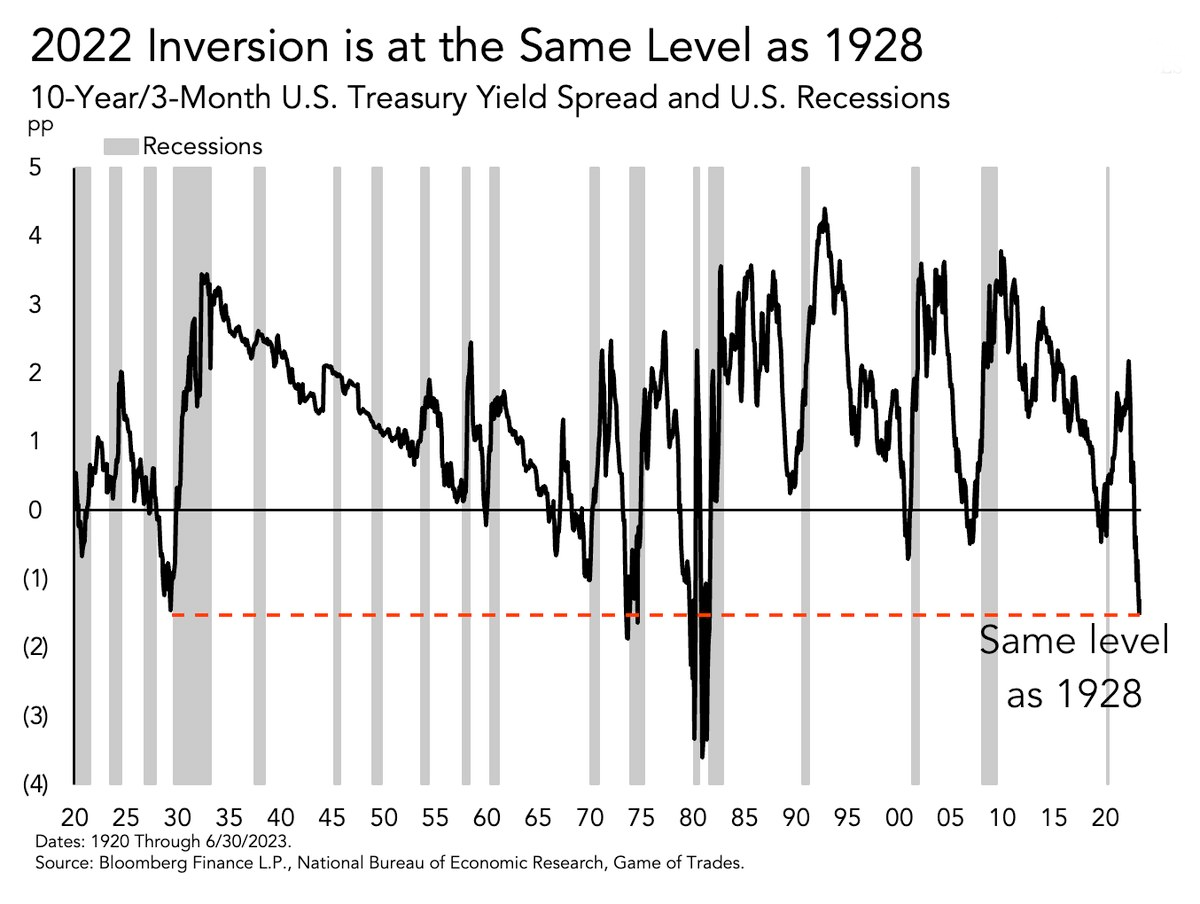

However, if in the short term, there is expected to be significant risk, then the yield for 2 yr bonds will increase faster than the 10 yr yield. When the yield for 2 yr is higher than 10 yr, let’s say, then that’s called a yield inversion, and that’s indicative that some shit’s gonna go down soon.

Other indicators are to look at stock volatility, and comparing 9 day vol to 20 day vol.