1376

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 26 Nov 2023

1376 points (94.5% liked)

A Boring Dystopia

15071 readers

37 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 2 years ago

MODERATORS

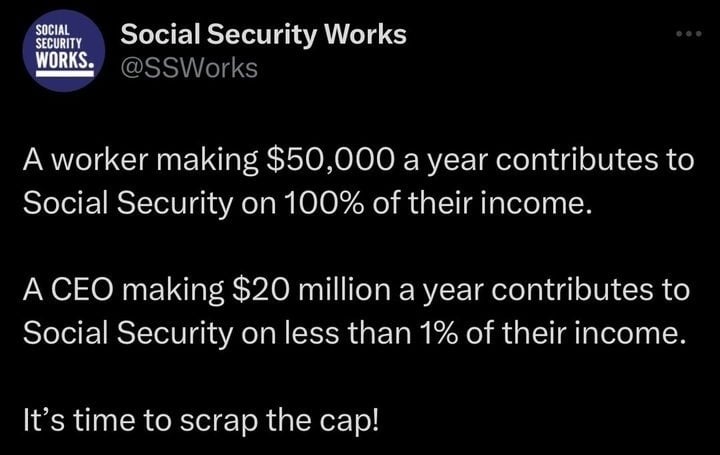

Reposting from another thread:

Social security has been 10-15 years away from being insolvent for 80 years. It will always be 10-15 years away from being insolvent because of the way it's calculated.

When the CBO or whoever scores it they can predict certain things like the number of recipients, the size of their payments, and inflation. They aren't allowed to take into account things that Congress may (but definitely will) do in the future, like raising the cap on social security taxes roughly with inflation. It went up from $160200 in 2023 to $168600 in 2024. This is a rare bipartisan, uncontroversial thing. Congress almost always follows the SSA recommendation exactly.

It would be more accurate to say "if the social security cap stays at $168600 for 10 years, social security will be insolvent."

The people pushing this bullshit know it's bullshit. They do it to make people think they'll never get social security so they can get enough voters on board with killing it, like they've been trying to do for 88 years.

Don't fall for it.

Apologies, but your specific example is incorrect. The cap on social security taxes is adjusted every year not by act of congress, but by existing law that indexes the cap to inflation. Therefore, it is already baked into the way it is scored and is not ignored.

You are correct that scoring cannot take into account any actions congress may take.

This time is a little different though than history. From 1984-2020, Social Security took in more in revenue than it paid out on benefits. It is now running at a deficit. Since being formed, it has run at a deficit less than 15 total years, and most of them earlier on. The social security trust fund has never been depleted during that time either. Without any changes to law, it will continue to run at a deficit until the late 2030s when the trust fund would be depleted and taxes alone would cover a projected 80% of benefits.

That 80% is why it's bullshit to your point. There are so many simple, easy ways to solve this and if they do nothing, we could continue to pay out 80% of benefits with no other changes but that'll never happen. It would be political suicide to literally starve our retired population. My favorite way to address it is removing the cap, but there's other small adjustments that make a huge difference. Things like changing the inflation adjustment to a similar but lower index, raising the retirement age, raising the tax by less than a percent, means testing, etc ... and the thing that pisses me off is the sooner we take one of these actions, the more of the trust fund is preserved, and the impact is so much greater. I don't like the other solutions and would strongly prefer raising the cap, but I'd take most of them over inaction, depleting the trust fund, and reducing benefits.

I was trying to keep it short and simple by skipping a step but yes, the SSA follows a formula to raise the cap. But anything the executive does must be authorized by Congress, including the current formula which was set in a reauthorization bill back in the 80s (I think, maybe the 70s, apologies, but I'm not able to look it up right now). So far, every time a budget is passed and every few years when the SSA needs to be reauthorized, they've left them alone. Despite the occasional bill messing with the SSA getting introduced, they never get out of committee.

As far as the CBO goes I don't recall ever reading about cap increases in their report summaries on the trust fund. Although I have read their reports on the effect of various proposed changes to the way the cap is calculated. I'll have to do some more looking when I have the time, but I was definitely under the impression cap increases were in a category the CBO didn't anticipate future changes to when evaluating the health of the trust fund. I thought normally the COLAs would also fall into this category but that is overridden by them being mandatory spending, as opposed to discretionary, so they have to be taken into account. I'm certainly no expert and wouldn't be surprised to find out I missed something.

It's still time to scrap the cap of $168,600 income that has to pay in. Pay the full amount on all our income, or GTFO of the US.

Says the kender? An entire RPG culture based on "innocent" theft and misappropriation? Hunh.

edit: Ah tes, the downvoters are, yet again, too young to know better. When will Reddit stop leaking? 🤦🏼♂️

Ok, I will engage as a Kender.

First of all, me calling myself a Commie is actually superfluous here as evidenced by the Siberian natives that were so damn communist that the USSR couldn't deal with them.

Secondly, the fact that you use the artificial concept of ownership to describe Kender society, shows that you know nothing of Kender. We own nothing, we don't understand ownership at all, unless you big folk explain what you mean.

The biggest crime one can commit as a Kender is not having children. That comes because we are afflicted with wanderlust. I'm a perfect example of this having lived in 49/50 states in the US, and planning to "'retire'" on a ship that I own, but pay for with charter cruises to everywhere else I can get to. I digress.

If you don't return to Kenderhome by your 60th birthday and have at least two children with your council chosen betrothed, or a romantic partner, then we will dispatch bounty hunters to bring you back, alive, and deposit you in the "palace" of Kenderhome. You are then on house arrest, and not able to leave the grounds. This is possibly the worst possible punishment one could give a Kender, other than solitary confinement, thankfully all your locks are trivial for us to pass through, so no one has ever held a Kender in solitary confinement.

The Kender on the whole are an annoyance to those of you primitive races that understand the concept of ownership, but that's not our fault. You should learn the concept of belonging.

Edit, I didn't downvote you.

Edit 2: I'm less than 20 years from having to have podlings, if Krynn has a direct connection to us.

Edit 3: while I have created a Hoopak and a Chappak, IRL, I don't own them. If you need to borrow the Hoopak, or the Chappak,.or pretty much anything else in my possession, I will happily lend it to you, knowing you'll give it back to the community as good, or better, than you got it. It's a real shame I can't rely on normal humans to do the same.

Edit 4: All Weapons should also be tools and musical instruments.

Edit 5: Yes I'm an angry Kender. We only use money because you force us to. We have/had a society that works so damn well the biggest issue we have is forgetting to have kids. I'm extremely disappointed in the lack of progress, despite the insane amount of wealth that human society has produced.

Ah, the inherent sovereign citizen BS in kender "culture". Color me surprised.

Hardly. You're too big to understand us little folk.

That's populism, and left populism is pretty strong here.

Your logical fallacy is showing, and your comment is wholly bullshit. Bye, Felicia.

True men of culture watched the credits and know it's spelled Felisha.

They spend more as they get in, it will run out. No amount of tomfoolery will change that.

They've been saying that my entire life, my dad's entire life, and when my dad was my age, my grandfather would tell him he's heard the same things his entire life going back to the 40s.

For a couple decades the disingenuous doom -and-gloomers told us no way could social security ever deal with the baby boomers. All through the 80s and 90s they told us we might as well privatize it or kill it all together. The only time wall street shut up about it was when they were too busy jerking off to the thought of getting their hands on that money. Well, the youngest of the boomers turn 60 in '24, they're almost all in and the end times keep getting pushed back, from the 80s to the 90s to the 00s to the 10s to the 20s and now 2035. It's like a doomsday cult that keeps pushing the date when the apocalypse doesn't arrive at the appointed time.

You'll have to excuse me for not getting worked up over the 40th new year I've heard for the sky falling.

And for what it's worth, managing the COLAs, the cap, the percentages, and anything else the SSA has done throughout it's existence isn't "tomfoolery," it's accounting. And damn good accounting so far. The SSA being such a well run government institution probably makes republicans hate them almost as much as the tax itself.

LOL, just posted the same, but not nearly so learned or eloquent.

KIDS: You're getting your Social Security. And remember, us old folks are not going to go senile and vote against it!

It's called the "third rail" of American politics for a reason. Touch it, you die.

People here making 90s talking points like they're still relevant in this political climate. Have you seen the people Republicans vote for? Have you seen this Supreme Court?

That shit is out the window.

Sure upto now it's been fine...

But a WHOLE LOT of new people will be getting check soon..

And military and debt spending are through the roof And the normal people are paying groceries and rent with their credit card...

I'm. Sure they'll solve it tho, last minute.

That exact comment would be at home in a letter to the editor in response to an article in any newspaper, in any year, for the past 80 years. And on any discussion board from the earliest days of the internet until now.

I'm not going to make any assumptions about your age or the length of time you've paid attention to these issues, but if it's only been a decade or so, you should start seeing the pattern soon. It won't even be at the last minute, it'll just keep slowly moving out so it's always 10-15 years away. Don't let them scare you into helping them do what they've been trying for 88 years.

This program has kept a lot of elderly and disabled people out of poverty. Don't let them take it.

The current trust fund is > $2T.

No.

"Tomfoolery"? Step away from the idiot box, gramps.

Sure granny, go believe them,I'm sure those 2 trillion arnt in some loss leading 1% government bonds

Have you not been paying attention to what the Fed has been doing? Pardon my language but shoving cash up my asshole earns more than 1% these days.

In 2022, before most of the rate hikes, the trust fund earned $66.4 billion. This year's high, and hopefully very temporary, interest rates aside, it'll usually be around 2.5-3%.

I'm not sure what you think loss leading means or why you're using it here, but governments storing reserve money earmarked for a specific purpose in their own bonds isn't unusual or a bad thing. Should they stuff it under a mattress earning 0%? Should they risk it in the markets? Unsecured domestic bonds? Foreign bonds?

Sorry, I must admit I'm not from the us and I may have been more talking/afraid for my local governments funds.... Thanks for the great explanation tho!

So pissy you can't even type straight? Breathe, tiger. Go touch grass.

Now you're cheating, cause that would be good advise always.