1376

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 26 Nov 2023

1376 points (94.5% liked)

A Boring Dystopia

15071 readers

171 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 2 years ago

MODERATORS

GenX here. Got some free financial advice in 1993 or so. Asked about Social Security being cancelled because my entire class ('89) said we didn't expect to receive it.

She looked me straight in the eye and said, "No. There will be riots in the streets before Social Security is cancelled. This is a non-issue, you're getting it. Any other concerns?"

GenZ, 30-years later, "We're gonna get cancelled!"

No fuck you won't. Old people vote. Isn't that what they're always bitching about? Think we'll shoot our retirement straight in the skull?!

Also Gen X, graduated in '96, and was warned by my econ/government teacher that we need to have well funded IRAs, because we won't be getting enough social security benefits to even pay for food, much less rent, medicine, or healthcare.

This is what they mean when they say Social Security is basically bankrupt. It won't pay for shit, and I live with people who currently draw on SS. It already doesn't even pay the 1/3 of their retirement it was supposed to. We don't get the retirement plans (pensions) from the companies we work for that was supposed to cover that last 1/3 of our retirements.

It was supposed to be a three-pronged plan: Social Security, 401k, and corporate pension. Each of these has problems on their own, but a hybrid solution could cover for each other's issues.

Now, corporate pensions are rare, 401k's are highly vulnerable to stock market crashes, and Social Security is being slowly strangled.

not really. short term investments and speculation are vulnerable to short term market forces, but a 401k that sits for 30 years with regular contributions and profits reinvested is all but guaranteed to make money. Long term investments like that are extremely stable, just put the money in your 401k and don't look at returns until you're actually considering retirement.

What's critical is where the stock market is at when you retire. Stock market crashes coming with general economic problems mean older people lose their jobs, can't find another one, and are forced to retire with 40% of their 401k value knocked out. This is exactly what happened to people in 2008 and '09.

Conversely, the stock market did really well in the years after that. The people who were able to hold out past 2012 were able to get a nice nest egg saved up.

It's a dice roll. It can work as one part of a larger system, but not on its own.

40% of the value before the crash, I assume? In that case, what's the difference between their contributions and the total value even with that 40% gone? Remember that the real value of an investment is how much money is there now vs how much you put in, not how much money is there at peak value vs how much money is there now.

The demographics are probably a bigger part of it. The ratio of people collecting to people paying in is much larger now and the length of time people collect on it is longer since people live longer now.

No problem, just make a self-directed IRA that buys bitcoin. Immune to stock market crashes!

Most corporate pension for workers are a joke. All the money goes to the top few.

!remindme 20 years

Now, that's optimistic. 🤣🤌🏼

However we do have the worst case scenario of 75% of planned hanging over our heads. In the next ten years or so, either we’ll take a big hit on income or there will be painful changes to prevent it. I don’t like either of those. Like everything else we can’t seem to do, the best fix is to do it ahead of time to greatly reduce the impact. It is important that Congress get off their asses and address it now so whatever adjustment will hurt less.

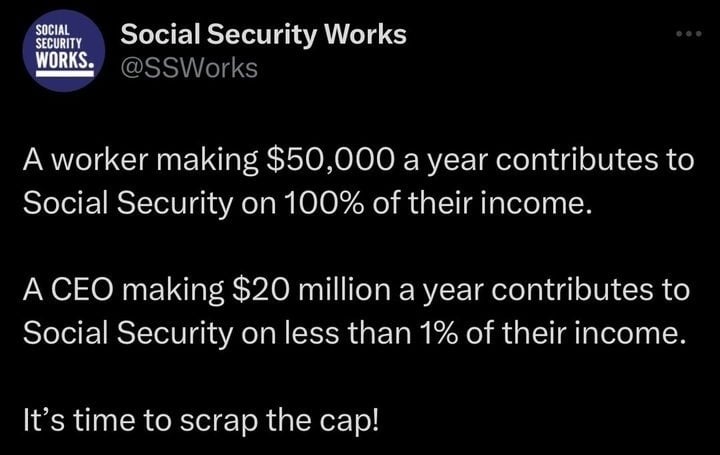

Previous adjustments have included raising the cap, taxing more benefits, raising the retirement age, and changes to the formula for cost of living adjustments. We really ought to consider a balance of all those and more so we spread the pain

They will make laws to change it but grandfather in people born before a certain age

Yeah, this isn't 1993 anymore. People will absolutely vote for lunatics willing to get rid of SS. And they will get rid of it if they have the chance.