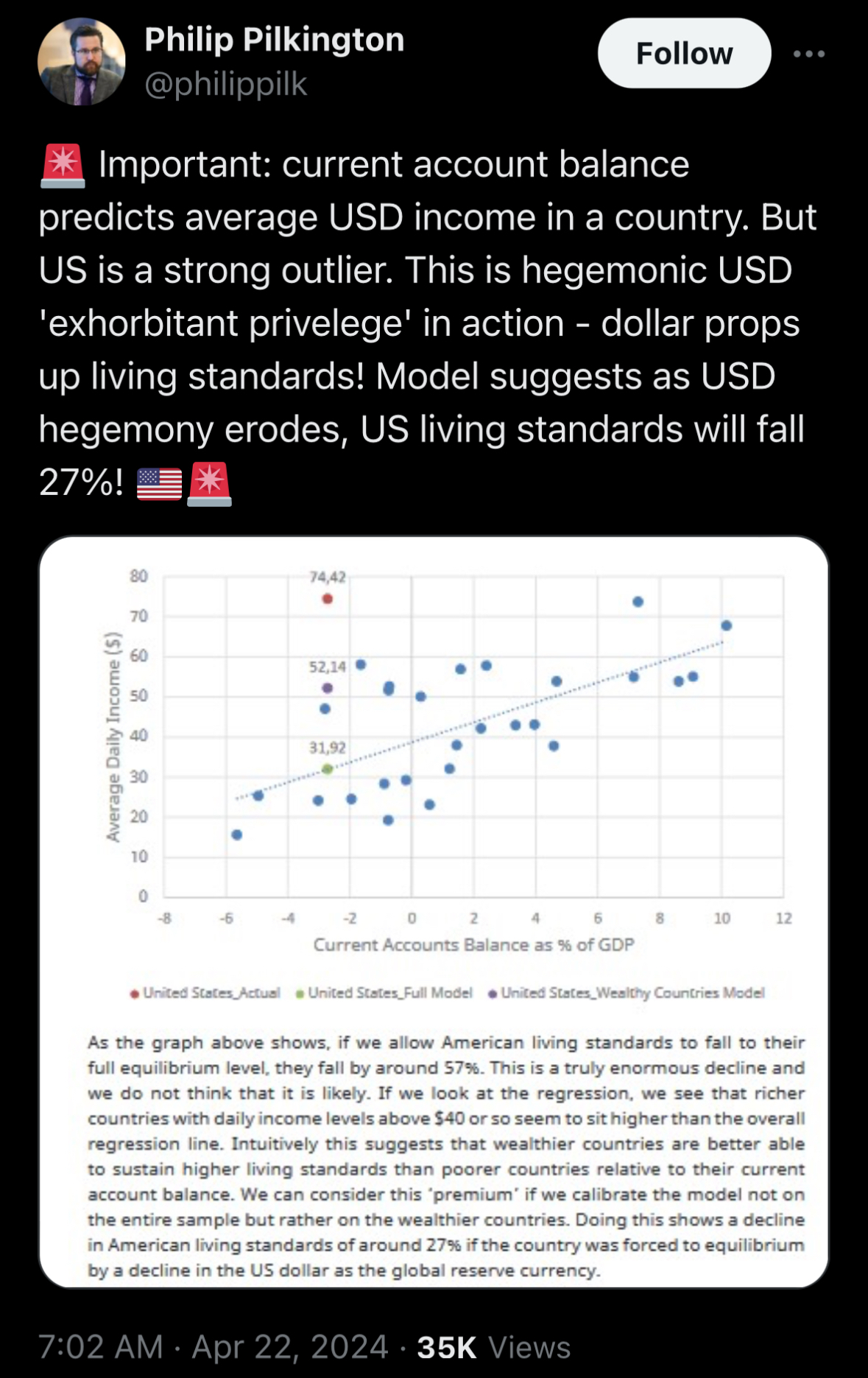

Thought this was an interesting analysis, though I think it needs to be taken with a bit of a grain of salt (I think it’s power is what is qualitatively describes rather than precise numbers, and I think the author might even agree with me).

I’m always on the lookout to see it quantified how much the average American benefits from imperialism. My guy says if the US was unable to exert hegemony, the US would experience at least what Russia experienced in the 90s. These numbers align with that; and this is only talking about dollar hegemony and not, for example, the US using military pressure, sanctions, or other methods for extracting cheaper resources and goods from the global south.

That said, I’m not sure you can just run a regression and get your answer. I don’t see how you can isolate the US losing dollar hegemony without it then creating an uncountable number of secondary effects. All this stuff is deeply interconnected. But that said, I think this does a good job of highlighted at least in a qualitative sense just how much Americans benefit from dollar hegemony, and how losing that would be huge problem for the US economy.

It depends on how quick the shock is. If America plans around and mobilizes domestic resources then it would be able to arrest some of that decline.

But the American political class right now appears to be allergic to any state lead central planning.

Would it be just a loss of fancy treats? Living standards and incomes aren't completely correlated. Cuba has excellent Healthcare but low income. US has meh healthcare for a country that "Rich" but there is also medical debt.

What really fucked up Russia in the 90s was not just a shift from socialism but also how quickly and to the extent it was done. It's called shock therapy for a reason. China also saw higher than usual inflation during 90s with its own economic reforms but nothing like Russian hyperinflation.

Another question would be why would say China quickly stop sending goods to the US when such a sudden shock would fuck up China too. U.S. is only able to obtain Chinese goods because China is willing to give away its own instead of using it for local consumption (though this has been changing since the last decade).

Sure, there is more coercion with other developing countries as you mentioned with sanctions and of course, countries with low productive forces requiring dollars inorder to develop.

I think the dollar would face a slow decline over decades with countries wanting to trade in other currencies. But does for example China want Yuan to replace the dollar?

They seem to be pursuing a path where the Yuan is used for trade and account settlement with not much interest in being a reserve currency, or at most as one reserve currency in a multipolar reserve system.

There are in fact downsides to being a reserve currency since the demand for dollars means that dollars themselves are an export item for the US in the form of government bonds, and on top of issuing bonds the demand for dollars also requires a trade deficit which hurts local production, especially manufacturing and depresses wages in export-oriented industries.

Also since the US grows less quickly than the global economy overall, the demand for dollars internationally relative to the size of the US economy is growing, meaning that the trade deficits must keep getting bigger, meaning that export oriented industries become increasingly hobbled.

Now the benefit of course is that it’s a license to print money. The US government is able to run staggering budget deficits and this is actually good for the US economy because it reduces the burden of the trade deficit by supply the world dollars that way instead, and while it’s awful for export-driven industry such as manufacturing and manufacturing workers, it’s a positive for service & knowledge workers since they get a lifestyle boost from cheap imports.

China doesn’t seem interested in having to “satisfy demand for yuan” by running a trade deficit because that would hurt Chinese manufacturing and industry, but they also don’t want to be funding the US budget by needing to buy USD to use for their own international trade settlements, so they’re pursuing a path of bilateral and sometimes regional agreements where settlements are done using local currencies directly instead of USD.

Basically they don’t really want to be a reserve currency, or only a small one perhaps to enable some deficit spending without trashing the balance of trade.

I don't think US budget deficits is the big issue, it is high sure and wasted on unproductive shit with all the military spending but you should be looking at current account deficit instead, which is the world's highest.

Having control over the reserve currency mainly gives you the privilege to import much more than you would able to otherwise since other countries are "willing" to take your reserve currency for goods.

Not all countries can a surplus or a deficit at once. It's why Germans complaining about lazy Greeks during debt crisis was ridiculous. The Greeks were only buying German goods because Germans were willing to sell it to them. And because Germany was strangling domestic workers who wouldn't be able to buy the goods they made themselves.

China right now has a trade surplus. So, I don't really know how much advantage it would give them to have their own currency be "wanted" outside other than bypassing sanctions and soft power. Eg. Recently India wanted to buy crude from Russia but of course, sanctions. They could have an Rupee-Ruble arrangement but that would result in one side (Russia) accumulating too many Rupees which it doesn't need.

So, Russia asked India to provide Yuan instead. Since Russia can then use Yuan to buy from China. But of course, India wouldn't want that.

That's the difference between having the Yuan be a trading currency or a reserve currency. From what I understand, creating bilateral agreements allows China and it's trading partners to de-risk from the american political system. But allowing the Yuan to become a reserve currency, which is then speculated upon overseas, would give China currency hegemony. Yes, the Chinese could then use that metaphorical gold mine to invest productively. But all the incentives the US had to export their industries overseas would still be there. If the USD hegemony can be understood as a resource curse, then an Yuan hegemony can be as disruptive to the chinese political system as it was to the post war american political system.