Thought this was an interesting analysis, though I think it needs to be taken with a bit of a grain of salt (I think it’s power is what is qualitatively describes rather than precise numbers, and I think the author might even agree with me).

I’m always on the lookout to see it quantified how much the average American benefits from imperialism. My guy says if the US was unable to exert hegemony, the US would experience at least what Russia experienced in the 90s. These numbers align with that; and this is only talking about dollar hegemony and not, for example, the US using military pressure, sanctions, or other methods for extracting cheaper resources and goods from the global south.

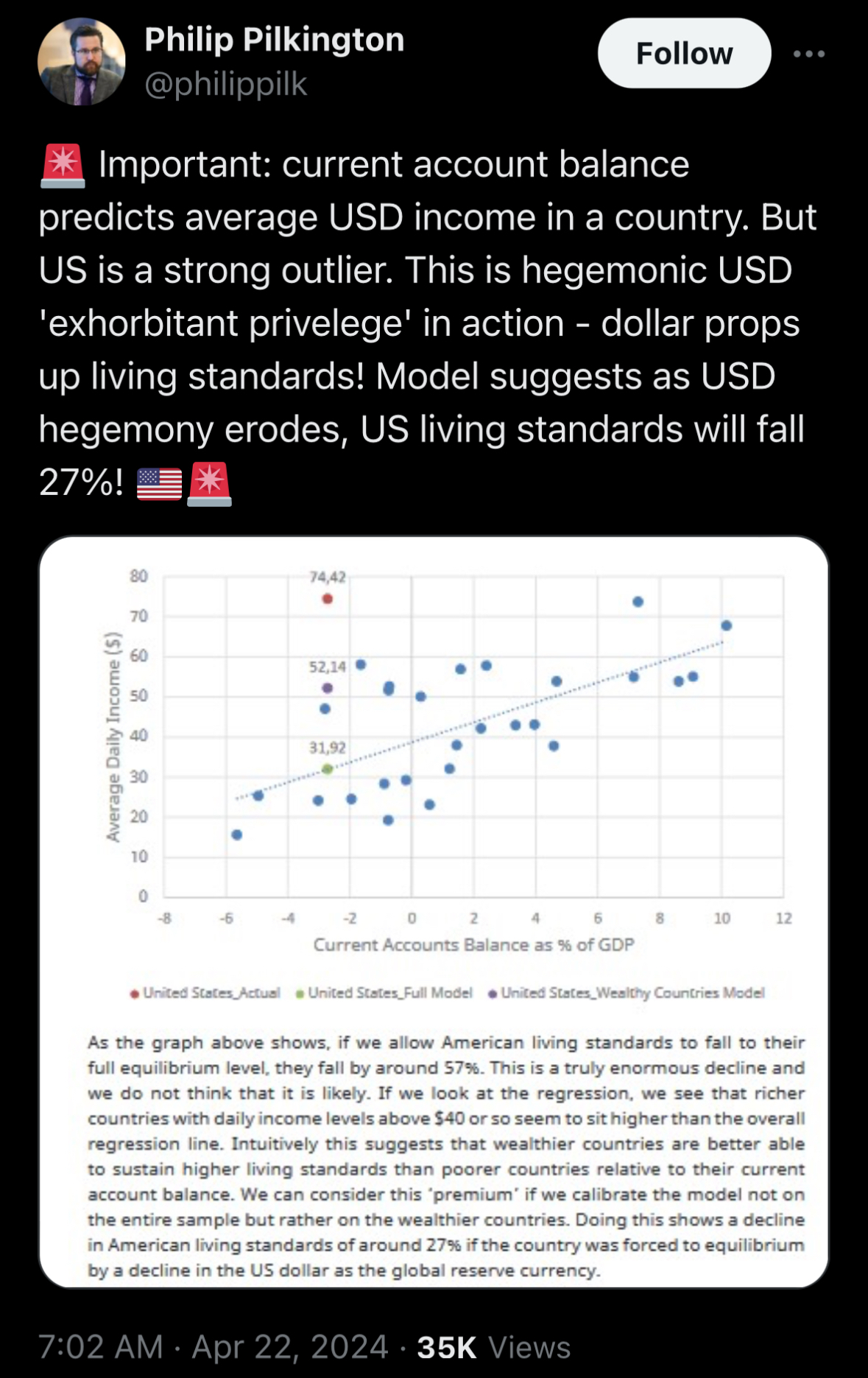

That said, I’m not sure you can just run a regression and get your answer. I don’t see how you can isolate the US losing dollar hegemony without it then creating an uncountable number of secondary effects. All this stuff is deeply interconnected. But that said, I think this does a good job of highlighted at least in a qualitative sense just how much Americans benefit from dollar hegemony, and how losing that would be huge problem for the US economy.

I don't think US budget deficits is the big issue, it is high sure and wasted on unproductive shit with all the military spending but you should be looking at current account deficit instead, which is the world's highest.

Having control over the reserve currency mainly gives you the privilege to import much more than you would able to otherwise since other countries are "willing" to take your reserve currency for goods.

Not all countries can a surplus or a deficit at once. It's why Germans complaining about lazy Greeks during debt crisis was ridiculous. The Greeks were only buying German goods because Germans were willing to sell it to them. And because Germany was strangling domestic workers who wouldn't be able to buy the goods they made themselves.

China right now has a trade surplus. So, I don't really know how much advantage it would give them to have their own currency be "wanted" outside other than bypassing sanctions and soft power. Eg. Recently India wanted to buy crude from Russia but of course, sanctions. They could have an Rupee-Ruble arrangement but that would result in one side (Russia) accumulating too many Rupees which it doesn't need.

So, Russia asked India to provide Yuan instead. Since Russia can then use Yuan to buy from China. But of course, India wouldn't want that.

That's the difference between having the Yuan be a trading currency or a reserve currency. From what I understand, creating bilateral agreements allows China and it's trading partners to de-risk from the american political system. But allowing the Yuan to become a reserve currency, which is then speculated upon overseas, would give China currency hegemony. Yes, the Chinese could then use that metaphorical gold mine to invest productively. But all the incentives the US had to export their industries overseas would still be there. If the USD hegemony can be understood as a resource curse, then an Yuan hegemony can be as disruptive to the chinese political system as it was to the post war american political system.