view the rest of the comments

news

Welcome to c/news! Please read the Hexbear Code of Conduct and remember... we're all comrades here.

Rules:

-- PLEASE KEEP POST TITLES INFORMATIVE --

-- Overly editorialized titles, particularly if they link to opinion pieces, may get your post removed. --

-- All posts must include a link to their source. Screenshots are fine IF you include the link in the post body. --

-- If you are citing a twitter post as news please include not just the twitter.com in your links but also nitter.net (or another Nitter instance). There is also a Firefox extension that can redirect Twitter links to a Nitter instance: https://addons.mozilla.org/en-US/firefox/addon/libredirect/ or archive them as you would any other reactionary source using e.g. https://archive.today . Twitter screenshots still need to be sourced or they will be removed --

-- Mass tagging comm moderators across multiple posts like a broken markov chain bot will result in a comm ban--

-- Repeated consecutive posting of reactionary sources, fake news, misleading / outdated news, false alarms over ghoul deaths, and/or shitposts will result in a comm ban.--

-- Neglecting to use content warnings or NSFW when dealing with disturbing content will be removed until in compliance. Users who are consecutively reported due to failing to use content warnings or NSFW tags when commenting on or posting disturbing content will result in the user being banned. --

-- Using April 1st as an excuse to post fake headlines, like the resurrection of Kissinger while he is still fortunately dead, will result in the poster being thrown in the gamer gulag and be sentenced to play and beat trashy mobile games like 'Raid: Shadow Legends' in order to be rehabilitated back into general society. --

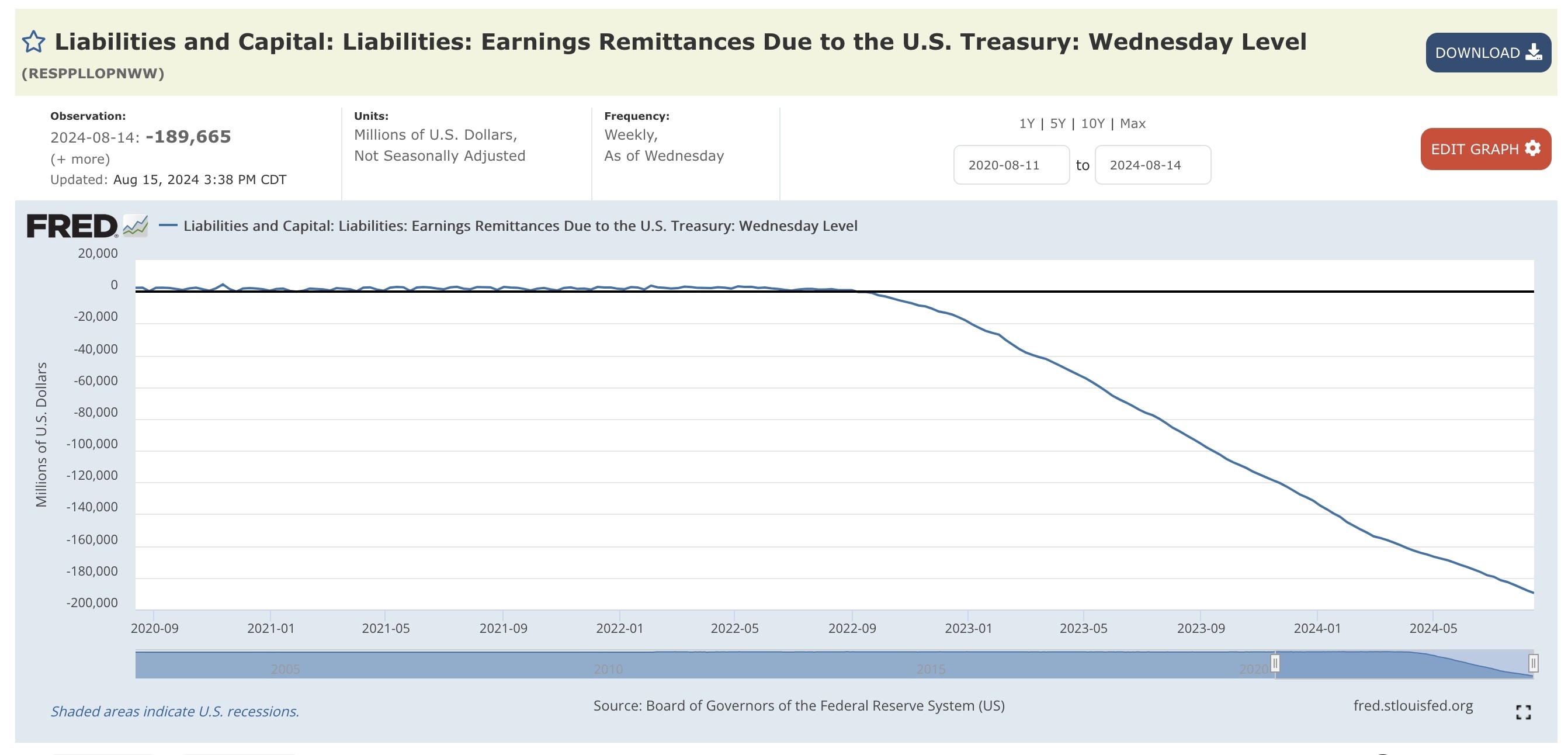

A bit longer explanation of the graph. The US Treasury is effectively the owner of the Federal Reserve’s entire balance sheet. Any profit or loss resulting from the Fed’s monetary policy actions flows back to the Treasury.

For a long time, the Fed’s income from holding Treasury debt and fees from financial institutions outweighed its expenses (like interest paid on reserves and operational costs).

However, when the Fed raised interest rates on reserves from near 0% to around 5% in 2021-2022, its expenses surged. This was because the Fed had trillions of dollars in reserve liabilities after years of Quantitative Easing (QE) – buying Treasury bonds and Mortgage-Backed Securities (MBS) to stimulate the economy.

Reserves are liabilities with variable interest rates, so the Fed’s expenses rose immediately. Meanwhile, its assets (mainly Treasury securities and MBS) pay fixed interest, so their income didn’t increase.

Here’s the problem: the value of the Fed’s assets fell when it raised interest rates. This normally wouldn’t be a major issue, as the Fed could just hold those assets until maturity and receive their full value. However, the Fed has been shrinking its balance sheet via Quantitative Tightening (QT) - selling these securities back into the market at a loss.

The overall impact is that the non-government sector now has more claims on the government than before. Essentially, the government spent money into the economy, exchanged that spending for Treasury bonds, the Fed bought those bonds, and is now selling them back at a loss

The key takeaway is that the Fed’s decisions to raise interest rates and conduct QT have increased the government’s overall interest expenses. This leaves less room for non-inflationary public spending on vital areas like healthcare, education, infrastructure, and so on.

Another quibble, QT is when the Fed does not reinvest the principal of maturing assets. As far as I know, they are not selling any assets (unless they started selling MBS?). So they do not have to book the loss of value, but their expenses are now higher than their interest income

sure that's fair

This graph does not show all remittances. It shows the negative remittances that are held on the balance sheet as a liability, meaning that the Fed will pay back the government when they start making a profit again. Positive remittances are not held on balance sheet, they are paid to the Treasury immediately. The positive values in your graph is "capital", which is basically unrelated

This document shows Fed remittances over time, which have been substantial. See figure 2 https://www.stlouisfed.org/on-the-economy/2023/nov/fed-remittances-treasury-explaining-deferred-asset

When they start making a profit again is doing a lot of work here. It's not at all clear this will actually happen in the foreseeable future. In the mean time, the operating budget is tightened because of ever increasing share of debt payments.

The Fed controls when they make a profit again, since they set the federal funds rate. When they lower that rate below a level that is straightforward to calculate, they will make a profit. It is incredibly easy for the Fed to earn a (long-term) profit since they issue the currency and earn seigniorage

The ultimate purpose of the financial games the Fed plays is to protect the interests of large financial institutions. The only way that can be achieved within the context of the current system is by fucking over everyone else. That's what the Fed is doing right now.

I agree. I am mainly critiquing your graph. You are showing the losses, which are large and look scary. But you're not showing the context of how large the past profits have been.

And even in a world where the Fed is making profits by exchanging short duration for long, they are still providing a huge subsidy to the financial system. So it's not accurate to say these recent losses are a measure of the subsidy to financial institutions. It just feels like the dumb RRP graphs you see on superstonk

yeah that makes sense

So pretty much a doom spiral that can't end or else the market collapses as all the cocaine will run out?

pretty much yeah