back in my map era, we're ukrainemaxxing right now

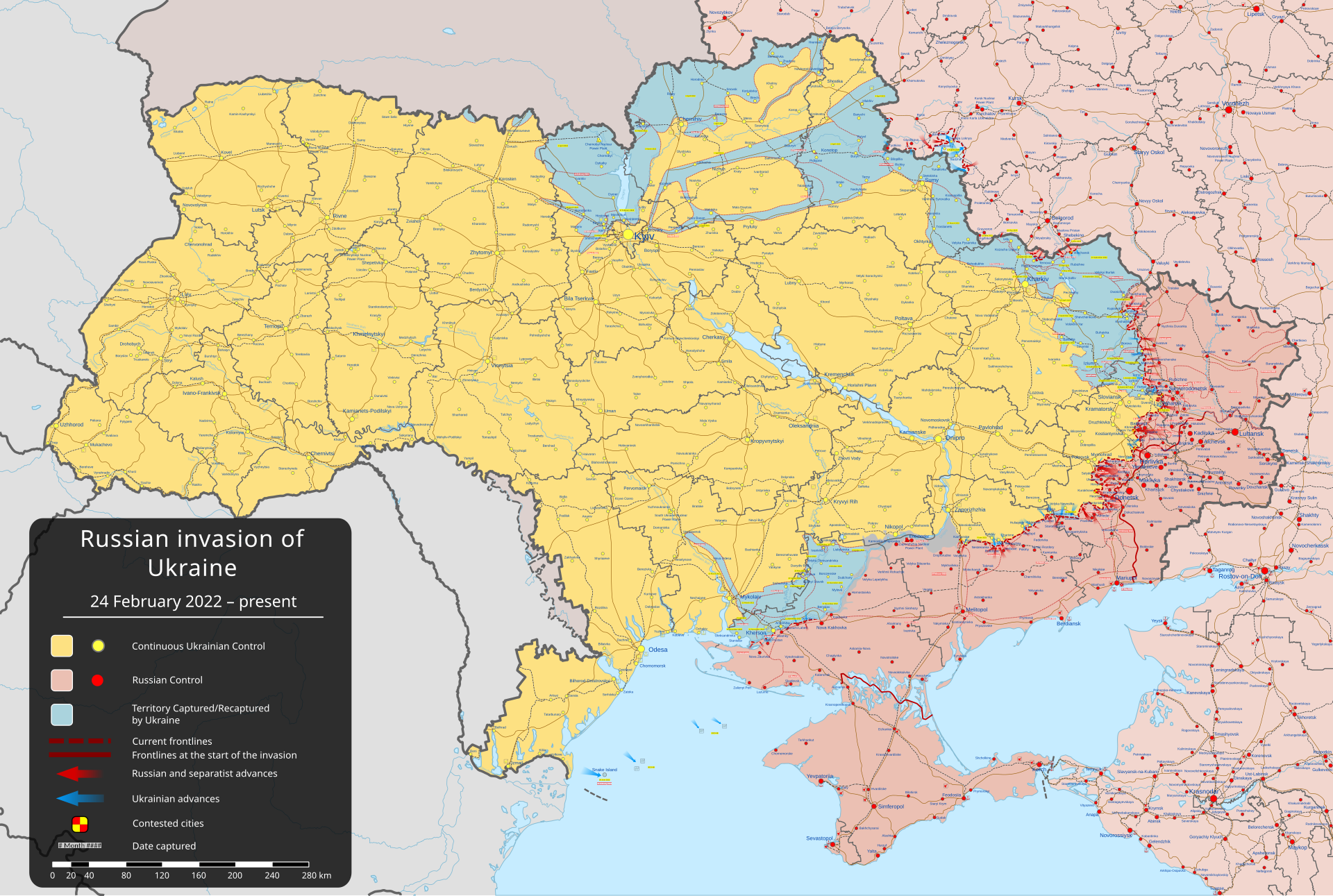

Declarations of the imminent doom of Ukraine are a news megathread specialty, and this is not what I am doing here - mostly because I'm convinced that whenever we do so, the war extends another three months to spite us. Ukraine has been in an essentially apocalyptic crisis for over a year now after the failure of the 2023 counteroffensive, unable to make any substantial progress and resigned to merely being a persistent nuisance (and arms market!) as NATO fights to the last Ukrainian. In this context, predicting a terminal point is difficult, as things seem to always be going so badly that it's hard to understand how and why they fight on. In every way, Ukraine is a truly shattered country, barely held together by the sheer combined force of Western hegemony. And that hegemony is weakening.

I therefore won't be giving any predictions of a timeframe for a Ukrainian defeat, but the coming presidency of Trump is a big question mark for the conflict. Trump has talked about how he wishes for the war to end and for a deal to be made with Putin, but Trump also tends to change his mind on an issue at least three or four times before actually making a decision, simply adopting the position of who talked to him last. And, of course, his ability to end the war might be curtailed by a military-industrial complex (and various intelligence agencies) that want to keep the money flowing.

The alignment of the US election with the accelerating rate of Russian gains is pretty interesting, with talk of both escalation and de-escalation coinciding - the former from Biden, and the latter from Trump. Russia very recently performed perhaps the single largest aerial attack of Ukraine of the entire war, striking targets across the whole country with missiles and drones from various platforms. In response, the US is talking about allowing Ukraine to hit long-range targets in Russia (but the strategic value of this, at this point, seems pretty minimal).

Additionally, Russia has made genuine progress in terms of land acquisition. We aren't talking about endless and meaningless battles over empty fields anymore. Some of the big Ukrainian strongholds that we've been spending the last couple years speculating over - Chasiv Yar, Kupiansk, Orikhiv - are now being approached and entered by Russian forces. The map is actually changing now, though it's hard to tell as Ukraine is so goddamn big.

Attrition has finally paid off for Russia. An entire generation of Ukrainians has been fed into the meat grinder. Recovery will take, at minimum, decades - more realistically, the country might be permanently ruined, until that global communist revolution comes around at least. And they could have just made a fucking deal a month into the war.

Please check out the HexAtlas!

The bulletins site is here!

The RSS feed is here.

Last week's thread is here.

Israel-Palestine Conflict

Sources on the fighting in Palestine against Israel. In general, CW for footage of battles, explosions, dead people, and so on:

UNRWA reports on Israel's destruction and siege of Gaza and the West Bank.

English-language Palestinian Marxist-Leninist twitter account. Alt here.

English-language twitter account that collates news.

Arab-language twitter account with videos and images of fighting.

English-language (with some Arab retweets) Twitter account based in Lebanon. - Telegram is @IbnRiad.

English-language Palestinian Twitter account which reports on news from the Resistance Axis. - Telegram is @EyesOnSouth.

English-language Twitter account in the same group as the previous two. - Telegram here.

English-language PalestineResist telegram channel.

More telegram channels here for those interested.

Russia-Ukraine Conflict

Examples of Ukrainian Nazis and fascists

Examples of racism/euro-centrism during the Russia-Ukraine conflict

Sources:

Defense Politics Asia's youtube channel and their map. Their youtube channel has substantially diminished in quality but the map is still useful.

Moon of Alabama, which tends to have interesting analysis. Avoid the comment section.

Understanding War and the Saker: reactionary sources that have occasional insights on the war.

Alexander Mercouris, who does daily videos on the conflict. While he is a reactionary and surrounds himself with likeminded people, his daily update videos are relatively brainworm-free and good if you don't want to follow Russian telegram channels to get news. He also co-hosts The Duran, which is more explicitly conservative, racist, sexist, transphobic, anti-communist, etc when guests are invited on, but is just about tolerable when it's just the two of them if you want a little more analysis.

Simplicius, who publishes on Substack. Like others, his political analysis should be soundly ignored, but his knowledge of weaponry and military strategy is generally quite good.

On the ground: Patrick Lancaster, an independent and very good journalist reporting in the warzone on the separatists' side.

Unedited videos of Russian/Ukrainian press conferences and speeches.

Pro-Russian Telegram Channels:

Again, CW for anti-LGBT and racist, sexist, etc speech, as well as combat footage.

https://t.me/aleksandr_skif ~ DPR's former Defense Minister and Colonel in the DPR's forces. Russian language.

https://t.me/Slavyangrad ~ A few different pro-Russian people gather frequent content for this channel (~100 posts per day), some socialist, but all socially reactionary. If you can only tolerate using one Russian telegram channel, I would recommend this one.

https://t.me/s/levigodman ~ Does daily update posts.

https://t.me/patricklancasternewstoday ~ Patrick Lancaster's telegram channel.

https://t.me/gonzowarr ~ A big Russian commentator.

https://t.me/rybar ~ One of, if not the, biggest Russian telegram channels focussing on the war out there. Actually quite balanced, maybe even pessimistic about Russia. Produces interesting and useful maps.

https://t.me/epoddubny ~ Russian language.

https://t.me/boris_rozhin ~ Russian language.

https://t.me/mod_russia_en ~ Russian Ministry of Defense. Does daily, if rather bland updates on the number of Ukrainians killed, etc. The figures appear to be approximately accurate; if you want, reduce all numbers by 25% as a 'propaganda tax', if you don't believe them. Does not cover everything, for obvious reasons, and virtually never details Russian losses.

https://t.me/UkraineHumanRightsAbuses ~ Pro-Russian, documents abuses that Ukraine commits.

Pro-Ukraine Telegram Channels:

Almost every Western media outlet.

https://discord.gg/projectowl ~ Pro-Ukrainian OSINT Discord.

https://t.me/ice_inii ~ Alleged Ukrainian account with a rather cynical take on the entire thing.

In the spirit of discussing the Chinese dollar bonds, i’d like to talk about “China’s Foreign Exchange Reserves: Past and Present Security Challenges” by Yu Yongding, published first in July 2022 (so 5 months after Russian forex got seized) and translated here. It concludes, amongst some other things, that “[China] should strive to avoid becoming a creditor as much as possible”.

The internationalization of the RMB is a good for security in the long term, but in the short term “even if China’s foreign exchange reserves consisted entirely of RMB assets, their security would not change.” Why? “Because the key to the problem does not lie in the currency that China’s foreign exchange reserves are denominated and settled in, but in whether China owes the United States money or vice versa.” If the US does not want to service the debt, then China is left in the lurch/ bag-holding even if the $1 trillion US dollars in China’s reserve magically turned into RMB. The security threat outlined in this article is China being stiffed to the tune of trillions, and the security solution outlined is to stop being owed anything. The author repeatedly notes how China’s current foreign exchange reserves generate negative investment returns, largely because they are over-leveraged. Most countries have much smaller reserves of dollars on hand. So Mr. Yu advocates for getting dollars out of the country in a way that generates positive investment income.

But why does China have so many US dollars? Shortly after China’s opening up, “the shortage of foreign exchange was the main bottleneck”. As such, the RMB was devalued sharply. In 2003, financial turmoil caused China to delay the appreciation of the RMB until 2005. As a result of the late appreciation, “China’s trade surplus increased sharply, and, on the other hand, the domestic asset bubble and the strong expectation of RMB appreciation led to a large inflow of ‘hot money’. China’s capital account surplus once exceeded the trade surplus and became the primary source of new foreign exchange reserves. It is fair to say that China’s failure to let the RMB appreciate in time and its lack of exchange rate flexibility were the conditions that led to the country’s excessive accumulation of foreign exchange reserves.”

Why can’t the RMB just replace the dollar? “In short, for the RMB to become an international reserve currency, China must fulfill a series of preconditions, including establishing a sound capital market (especially a deep and highly liquid treasury bond market), a flexible exchange rate regime, free cross-border capital flows, and long-term credit in the market. In short, China must overcome the so-called ‘original sin’ in international finance and be able to issue treasury bonds internationally in RMB. Otherwise, it will be difficult for the RMB to become an international reserve currency and RMB internationalization will remain incomplete.”

China will not do many of those things, because that would be giving up control of the economy to financial markets. But that’s the rub, isn’t it? China can’t establish itself as the world’s reserve currency, not least because its financial institutions are not ‘advanced’ enough. The USA is a decrepit shell that has spent 40 years hollowing itself out to be the best financial market possible. The current proposal seems to be using both of these facts to China’ advantage.

De-dollarization is a non-starter unless the US goes apeshit crazy with SWIFT sanctioning. SDRs are cool, but the World Bank and IMF are USAmerican puppets for shock therapy. A bancor would require a lot of diplomatic work that no one will want to do for a while. Too many debts already exist denominated in dollars. The proposal with re-dollarization is to take advantage of the facts that China has too many dollars and some nice manufactured goods and that most of the Global South has commodities or other inputs for manufacturing and too much dollar debt. The US wants to be the turbo-finance hub of the world. Now, many of us here would argue that’s a broader manifestation of USamerica standing in the role as the current hegemon in a capitalist world and the tendency of the rate of profit to fall. At the ground level though, the finance people are blind dogs chasing blood, and they could not care less from where it flows. If the debts are getting paid, there shouldn’t be anything to complain about. And i personally doubt that the ‘Art of the Deal’ President is going to be some savvy financial genius. i think some guy once said something about capitalists selling the rope to hang themselves. As it is currently argued, China is setting up a win-win-win that slowly de-leverages their oversized dollar reserves and other countries’ debt.

Saudi Arabia may be mostly aligned with the West and the dollar, but that is a role they were forced into, not one they chose. The whole idea of the petrodollar comes from when OPEC tried to grab the “West” by the balls in the 70s and 80s, and then ended up with too much money to do anything with. Cash alone doesn’t do much in the desert. The US won that fight, because the Gulf States ended up recycling all of that money into US debt. Oil price spikes, a global recession, and soaring interest rates were the ingredients in the very first neoliberal shock. Interest rate and currency exchange rate manipulation led to IMF loans conditional on reforms, and the accompanying mass privatization and austerity. The US in 2024 has nowhere near the industrial or political capacity to pull off a second global financialization, mostly because there’s nowhere left in the world that hasn’t already been financialized. Even Russia and China represent financial markets outside the US’ control, not fully untapped markets. After 2008, quantitative easing, and the acceleration of money printing since 2020, domestic investors, banks, and the stock market depend on the federal interest rates in a way they really never have before. The snake is eating its own tail.

If anything, China’s attempts to do literally anything other than buying more US debt represents learning from the 80s. i do not see this as an obvious China L, though it may turn out to be.

This is simply not true. Post-war America exported dollars to rebuild Europe through Marshall Plan. China can do the same with the Global South countries, but with yuan.

It does mean that China will have to slowly give up its net exporter status as the cost of labor/wages increase, i.e. the living standards of its people increase and makes their export less competitive (which is GOOD)

And that China will have to share its productive capacity with the Global South to allow for a more equal development (which is GOOD)

And giving up its huge trade surplus means China would not be punished as bad with a Bancor-like financial arrangement and in turn makes them more amenable to get on board with this new system (which is GOOD)

And the end result of this is prying away the Global South dependence on the dollar will also bring about economic sovereignty to those countries colonized by Western imperialism (which is GOOD).

However, China has to give up its huge export capacity - that’s the price it has to pay to increase the living standards of its own people and those of the world’s.

America’s decline through de-industrialization is more of a consequence of Bretton Woods being chosen over Keynes’s Bancor (which allowed the US to go unpunished with its huge trade deficits and forcing austerity on the rest of the world, and hence the rise of the rentier class that makes huge financial claims over the colonized Global South countries), and the rise of Chicago school of neoclassical economics that took over the mainstream economics departments (to be fair, Keynesianism itself doesn’t help and it was doomed to fail anyway, but the Chicago school is far more pernicious than the Keynesians for sure).

If China can remain ideologically committed to Marxism (and not imported Western neoliberal nonsense), it doesn’t have to suffer from the same fate of hyper-financialization as the US.

i don’t agree, and moreover you aren’t replying to my point in general or to the aspect that you quoted. i literally did not say what you claim i am saying. this is, i feel, a consistent issue of yours. the marshall plan is irrelevant when half the reason Nixon ended the gold standard was France buying up too much USamerican gold with Vietnam dollars. its doubly irrelevant when the only reason it worked was the direct damage of the second world war and the lack of “efficiency” in European markets prior to the war.

i do not, at any point claim that China is on track for hyper-financialization. in fact, i explicitly argue that China is taking advantage of the US already having done so. America did not decline during de-industrialization, it ascended. if the common (white, cis, straight) working joe hadn’t been screwed over completely by finance, the American project would have ended in the 70s. you are conflating together three different currency regimes of USamerica, none of which are analogous to China’s current situation.

i do not associate the issues you are talking about with bretton woods. Polanyi’s The Great Transformation laid out everything that was going to happen before it did, long before the Austrians got involved. the connection between dollars and trade deficits has nothing to do with Keynesianism, an ideology/ economics program that has never been relevant in the USA. fully most of what you lay out here is the exact argument of the re-dollarization people that you have spent hundreds of words and many days arguing is farcical dogshit. what am i supposed to think you are saying?

For what it's worth, I often don't understand what either of you are saying

i do try and proofread my comments a few times to make sure i’m not saying anything too sectarian or jargon-y, and i would be happy to answer questions about anything i say in comments or pms. my issue with shipwreck/ xiaohongshu and what i see as a habit of willfully missing the point so they can restate their thesis aside, i am happy to discuss anything