Do you trust the DPP to not try some dumb shit together with a US anti-china neocon administration. Like an independence refferendum, constitution change or some (in)formal US bases popping up

This has strong Kaplya energy word to word tho they are @droplet now and your account is older. weird

Either way, how do Chinese households borrow to consume if both their savings growth, their income growth and the consumption growth have been comfortably and sustainably larger than HH debt growth? HH debt can also be a bunch of things not related to most aspects of consumption so unless we have some ready to go data we cant know where that debt went and its a huge leap to call China's consumption growth "debt fueled". Like HH have to borrow to be able consume but also HH savings are at the same time growing faster and higher than HH debt ? They get in debt to be able to sustain their consumption but also they are able save up more than the debt they get into ? Doesnt pass the smell test.

Also the aggregated debt figure compared nominaly against the GDP may tell us absolutely nothing about how distressed the average household balance sheet is given the income and regional inequalities in China in the last decade and the economic activity of different groups. Its much more likely that upper middle housholds and individuals leveraged too much on the property market and speculation (irregardless of their returns) and on the average household level i would imagine most debt figures have accumulated from the explosion of car purchases and payments that foundementaly add a bunch to HH debt calculation no matter how healthy peoples balance sheet is. So Its less of an issue if HH debt going up mostly as a function of mortgage penetration for higher income earners but not coming at the expense of savings or consumption (but also not financing those things) for the average houshold.

Also as far as the real estate sector bubble popping/delevareging goes that is already a reality for almost 3 years now. Sector has already dropped as a % of gdp by a notable margin, prices depending on city tier have droped from somewhat to a bunch . If that was to have any major impact on HH consumption we would have seen it by now. But HH consumption numbers follow the same trend and growth regardless. Connected to that is the fact that , yeah many people invested on real estate beyond buying their first house, but many for China is still a small minority of the population and concentrated in urban upper-middle class people. But how many Chinese people do you actualy think have invested in real estate and/or stocks? 30 million ? How many people borrowed to invest even , which is something you throw out with such certainty ? Many can be 4 million but are you sure thats an impactfull sum for China?

Ok lets imagine that. These 30 million people do contribute a lot in chinese consumption since they they make up a large chunk of upper middle class people like i said. And their grivances get disproportionate coverage both inside and outside of China. But the future of chinese society and economy isnt for them. Its for the 300 million class people moving up the ladder to a middle class lifestyle. The vast majority of these people didnt speculate on real estate or stocks and the deleveraging of the property sector not only doesnt hurt them but it actualy opens up the road for more affordable housing and as a result more disposable income for consumption. And thats what we have been seeing. From income to consumption to savings the YoY growth for that bracket has outpaced both GDP growth and that of upper-middle class chinese. Chinese govt does not in fact consider the pains of people who’ve already made enough money to gamble on stocks or speculate on real estate beyond owning the house they reside in as determinal to the engeneering of a future economy more fair and benifiting for the much larger working class people in lower economic brackets.

Tbf this is an 2008 report. Most of this may have been true or remain true in some capacity but 16 years are a lot for a movement and country, enough for things to take turns for the worse,public attitudes and priorities to shift, successes to be replaced and overshadowed by failures or absence. Not a great analogy but even the Shinning Path at some point enjoyed relativelywide public support and successfuly organized for the betterment of local and overlooked communities all over Peru

It varies tbh, only a couple of Toriyamas contemporaries have died and there are a bunch of foundational 60s mangaka or anime directors still alive pushing 85+ and even doing some work. Go Nagai for example (too horny to die probably) or Tetsuya Chiba (Ashita no Joe). Leiji Matsumoto died last year at 85 as well

To not put talk past each other i wanna note that the general question that policy decisions and directions depend on still stands?. How high or low is Chinese HH consumption actualy? Is it 35% or 55% ? If it isnt actually noticably lagging other developed asian or even western nations when calculated in the same manner then one can say "china must develop its consumer base" all they want but there actually be much less room to do so compared to the assumed one if HH consumption was actualy noticably weak. Its a different thing to try and bring a notably weak consumption to developed nation averages vs trying to bring a maybe somewhat bellow average consumption to gargantuan US consumerist brain levels. If the latter is needed for China to become a internal circulation and non exporter then i question the validity of such project or even its feasibility in timescales of 1-2 decades, or if it could have done something about it earlier on.

https://fddi.fudan.edu.cn/d3/ae/c19095a185262/page.htm And its not just random unnamed bloggers. Actual research in China seems to be approaching these figures again and breaking down the pocibility of underestimating Chinese HH consumption compared to other countries due to accounting and economic particularities

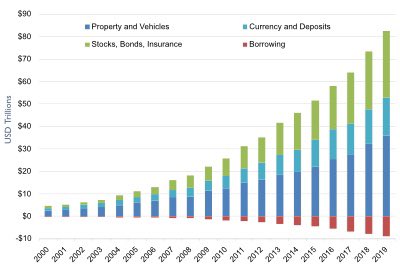

As for dept i dont think household borrowing has played an important role in the increase of Chinese household consumption. Also the aggregated figure may tell us absolutely nothing about how distressed the average household balance sheet is given the income and regional inequalities in China. It could very well be an upper middle class problem and for housholds and individuals who leveraged a bit too much on the property market and speculation. Those people were gonna be losers in any restructuring and deflation, controlled or not, of the property sector either way. Its less of an issue if Hh debt going up mostly as a function of mortgage penetration for higher income earners but not coming at the expense of a savings or consumption (but also not financing consumption) for the average houshold. If we want to make this argument looking at income cohort specific data is the way to go if you have them available. And its something that seems to be plateauing and even dropping either way in the last couple of years while consumption continues to grow. But Overall households seem well above water in total net wealth with healthy balance sheets.

Doesnt seem thats holding back household spending and deposits also can’t grow (along with consumption) following income and gdp gains if debt servicing is what’s eating peoples incomes.

800 million property units

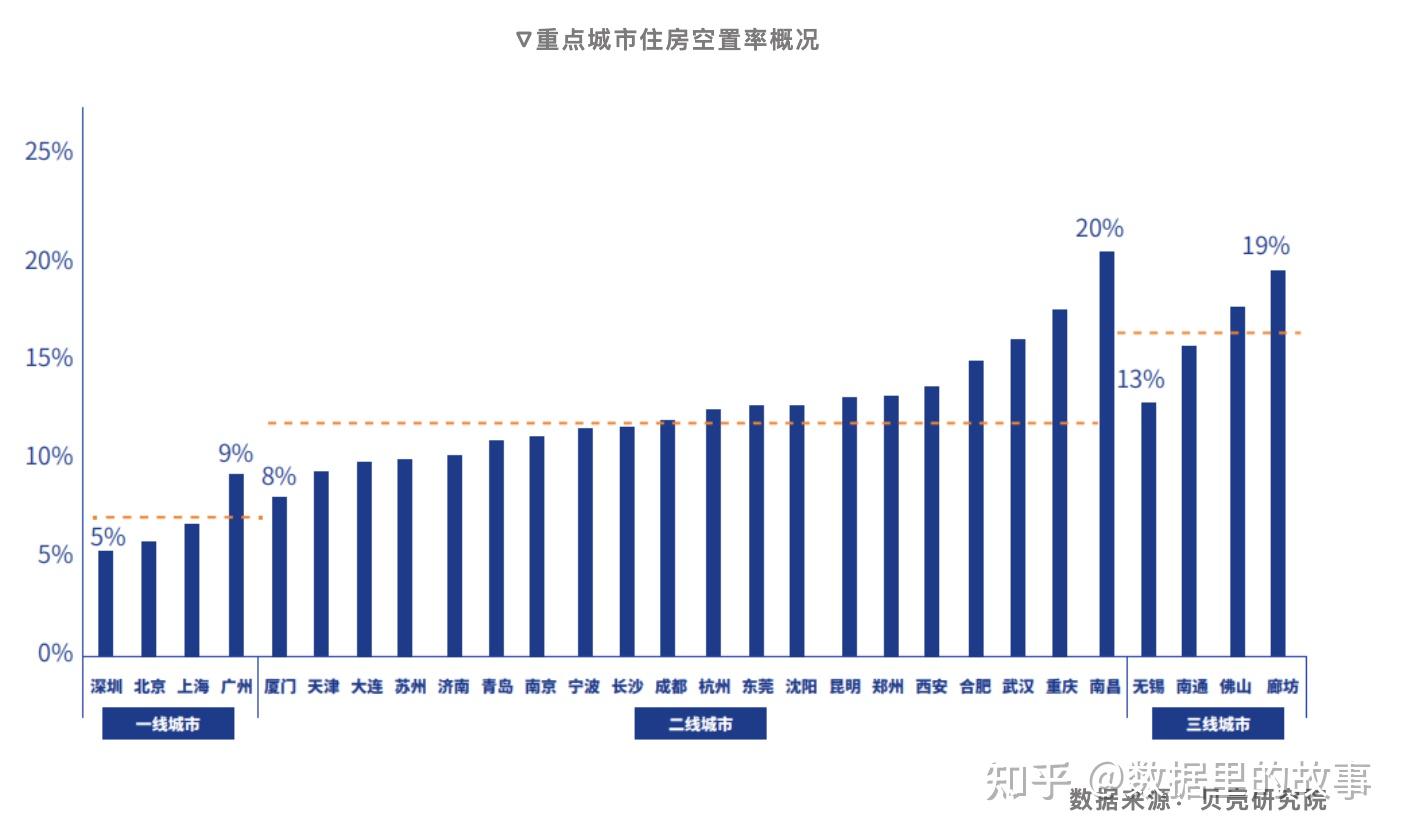

First of all what classifies as a "property unit" ? 800M property units doesnt equal 800M housing units. Offices, stores, garages, hotels. Its anything really. The numbers im seeing are 400 million Housing Units in Urban ereas, less than half of the urban population, with 60 Million Empty/vaccant/mid construction, which lines up both with the vaccancy rates i mentioned and with 800M total property units. How many "housing units" does the proffessor claim there are in urban China and what is the vaccancy rate on them, and what if any chinese survey or source there is on those numbers if he actualy claims them ?

Im trying to use Chinese sources at best i can but nothing seems to agree with anything close to 800 M urban housing units at 30+% Vacancy rates . Survey and Research Center for China Household Finance has total urban vacancy rates plateuing at ~20% of 300+M housing units in 2017. More recent surveys like this point out at decreasing vaccancy rates that now sit more in line with the numbers i mentioned. This includes housing units that are vacant for more than 3 months and excludes unfinished units. The numbers should be 2-3% higher than this but still that puts it comfortably bellow 20% overall as of now.

At worst urban overbuilding doesnt seem to go above 10% of tottal units build compared to most mature economies

Interesting post but you have made those points again elsewhere in the last couple of weeks ,i know your analysis and i agree in part even if i feel like some assumptions that it takes for granted are less so. But I was not arguing against it or against the point that China should or should not move away from being an exporter country or if thats where the whole play is. My response is questioning the viability and possibility of China NOT being an Exporter country given certain economic sizes and trends and what would such a tranformation entail and its consequences both for the composition of its domestic economy and its worldwide soft power. If the math even works out? I feel like you didnt answer those questions. Maybe the "facts" i laid out are wrong assumptions to begin with so id like to go over my comment and answer me when you have the time ?

If people were asking as a consequence of the meeting what was China's concession this time? Well its right here. China continues their commitment to non-interventionism, they continue to claim they wont fight the US. In doing so this is the result

Wtf do you want China to do for the Argentinian elections? Rig them or assasinate the ancap nutjob ? It wasnt close enough to be flipped by an agressive China intervention in the first place and its not like its losing some strategic ally. Argentina is gonna get worse with the clown and in 4 years time some socdem peronist will win and things will be more of the same. What is this "Well its right here?" that you so clearly see in this case?

Also where are you seeing this normalization and concession stuff ? The Americans were begging for a meeting for years and Xi went there in a position of strength and repeated every buzzword and positions China has stated in the last 10 years. There was no rhetoric shift. China is as non-interventionist today as it was 2 or 3 years ago. That may already be in issue yeah but that doesnt mean that somehow believe that they will have good peaceful relations with the US or that they conceeded their position in any international matter

wonder how those stats are calculated. The bottom 50% in 1930s China were literal serfs with a life expectancy of 30 doing borderline slavery to feudal landlords. Are we really gonna pretend they owned like 20-30% of the country's income share ? What does that even mean or matter in a feudal context

For Joe you only need to watch till 54 of the first season and then go to the second one. Beggining of Season 2 covers the same content most of S1 post ep 54 of S1 with better animation and without filler. Also make sure you torrent the amazing looking HD remaster S1 got recently . Miles ahead of the DVD rips that were the only way to watch till recently

I dont read chinese but google translate is surprisingly competent nowadays so the article is perfectly understandable.

Its an interesting and coherent perspective but im not gonna lie, you have basicaly repeated or paraphrased almost every single part of this article multiple times in your comments in the last few months. So if i thought that these general opinions and analysis you hold cover me and are convincing enough to substansiate these conclusions you throw around over this particular round of specific Chinese financial policies i wouldnt have asked what i asked in my previous comment. Either way i think i have been pretty specific in my comments in the last few days on the particular motivations and context of these measures and how at the end of the day they are much less concerned with foreign capital and investments and much more so reactive countermeasures to a delicate economic balance of domestic financial investment, consumption and prices during a period of dangerous deleveraging and restructuring that would have happened no matter US posture and strategies.

The connection of the article to all that boils down to: "Does the obvious 50 year constant that Wall street and western finance wants China to open up its capital markets and finance (a lot) more mean that China can never ever use even mild QE or take any measures that have that as a secondary superficial effect without it being "China falling into the trap and strategy of the US and its over" ? Can it never just be the arguably correct temporary tool in the hand of the Central bank and chinese regulators given a partciular domestic situation? Even if it helps China better navigate a period and challenge the US would wish it wouldnt