1376

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

this post was submitted on 26 Nov 2023

1376 points (94.5% liked)

A Boring Dystopia

15131 readers

118 users here now

Pictures, Videos, Articles showing just how boring it is to live in a dystopic society, or with signs of a dystopic society.

Rules (Subject to Change)

--Be a Decent Human Being

--Posting news articles: include the source name and exact title from article in your post title

--If a picture is just a screenshot of an article, link the article

--If a video's content isn't clear from title, write a short summary so people know what it's about.

--Posts must have something to do with the topic

--Zero tolerance for Racism/Sexism/Ableism/etc.

--No NSFW content

--Abide by the rules of lemmy.world

founded 2 years ago

MODERATORS

Stop spreading this BS. SS going bankrupt is misinformation.

Is it though?

(From Bard) "The Social Security trust funds are projected to run out of money by 2034. This means that the Social Security administration will only be able to pay out 77% of a retiree's full benefits."

Which I get isn't exactly the same as what OP is claiming, but it is still pretty concerning for those of us not close to retirement age

Read any SS Trustees report. It doesn't have "money", it has debt instruments (bonds), which are essentially a document saying "we the government owe ourselves a thousand dollars". You can print those all day, it's only sourcing that money that has any kind of direct consequence (taxation, inflation, etc.).

And yes, that does raise an interesting question of, what did they do with the actual money we paid into the programs, if the only thing in the trust fund is bonds.

Don't they pull from SS funds to pay for other things but then "give it back" at some point? I feel like I read something about that, maybe what's being paid back isn't "cash" but bonds?

In effect, the bonds I mentioned are just inverted loans. The Treasury takes in $1k from payroll taxes for these programs, issues a bond to the trust fund saying "I owe you $1k plus interest", spends the $1k on whatever (I guess primarily the discretionary budget) and eventually has to somehow generate money to pay it back with interest.

In terms of whether or not bonds were "borrowed" - this wouldn't exactly matter in a meaningful sense, but I'm not clear this ever actually happened in the first place. There was some claim about, when the trust fund was mixed with the general fund 1968-1990, maybe the government took bonds out of the program, but you have to remember that inside the government, that's not something of value, that's just an obligation the government has to pay to itself, it's a big nothing burger. The outstanding liabilities from Social Security to the actual beneficiaries (elderly people) exist regardless of how the government is doing their accounting internally.

It’s even more concerning for those of us who are close. Even most of us with savings are pretty reliant on that for retirement

Isn't "exactly" still means the statement "bankrupt" is false. Don't move goalposts in the claims. That's disingenuous and only adds to the misinformation.

I want to believe. Can you provide sources for that claim?

How about OP provides sources to their claim first.

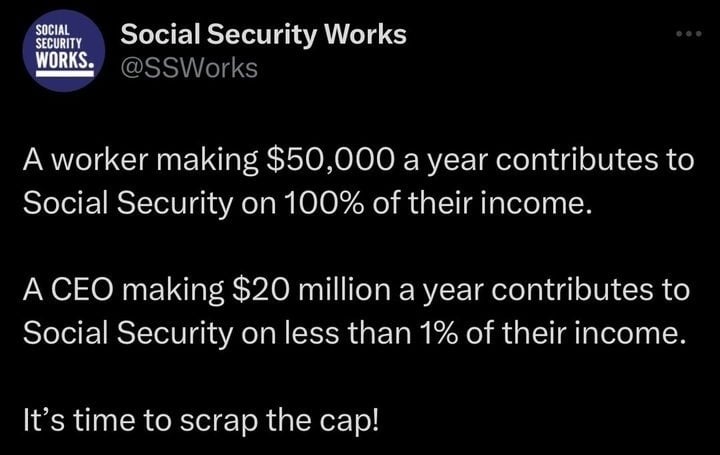

On one hand: fair. If you're not versed in elements of tax law this bit of data can seem arcane.

On the other: this is a matter of policy - not one of research. The definitive answer can be found with relative ease via a Google search. Here's a link to a Social Security Administration page on the topic: https://www.ssa.gov/OACT/COLA/cbb.html

By the math set out at the above link, one can calculate that, at a maximum income of $168,600 and a SS Contribution rate of 6.2%, the most any individual would contribute to social security in a year would be $10,453.20.

$10,453.20 would represent 0.052266% of the income of someone making $20 millions per year. Even doubling that amount (as some conservatives do) to count the employer's contributions to Social Security would leave you with just over 0.1% of net income.

So yeah, even if Social Security isn't going bankrupt, it's an anemic system that barely provides livable circumstances for those who depend on it. Raising or removing that "max income for contributions" limit would go a long way to seeing the system be able to actually support people who need it while only burdening those most able to bear the burden.

Ninjaedit: grammar