Once again, MMT is only a description of how money works, in the same way that hydrodynamics is a description of how water works. Hydrodynamics can tell you how to build a pump for a well, but not whether you would be violating someone's water rights. MMT can tell you how to utilize money to organize social activity, including the most relevant thing to us, building industrial capital, but it doesn't tell you whether bond markets or anyone else would allow you to.

In fact, half of Hudson's Killing the Host is about exactly how US institutions are completely beholden to finance capital, and would never allow the use of monetary policy to increase industrial production! Hudson uses the MMT framework to explain how the Federal Reserve prints staggering amounts of money to inflate the price of financial instruments (including stocks and bonds) for the benefit of financial capitalists, instead of printing money to inflate the prices of goods and labor which would lead to the formation of a productive economy.

The whole point of MMT is that money is just an organizational tool, like writing or calendars - as a technology it was invented (in the 'western' world at least) in ancient Mesopotamia and has persisted through multiple system of political economy. But in every case, its basic features are the same: it exists only as an IOU issued by a government, which can later be used to pay taxes, and a government with currency sovereignty can issue money at will to order people subject to its taxation (or who, for whatever other reason, need to obtain money denominated in that currency, such as, for instance, repaying IMF loans or making international trades) to hand over goods or perform services for the government.

Whereas this person is saying that the behavior of money depends on "the consensus of the monetary system's stakeholders", and the fact that the federal reserve didn't take action to slow rising treasury yields (i.e. falling global demand for dollar holdings) is proof that you "can't consolidate the central bank and treasury". They seem to go on a lot about "constitutional consensus" as a reason MMT doesn't work, as if the behavior of money in general through all of history is dependent on the specific provisions of a specific state's constitution. They say "it is a constant theme of their literature that the foreign sector can be treated as a non entity that does impose constraints on policy space" when that is literally the opposite of true, and Super Imperialism is primarily about how US interference in other countries' monetary policy prevents them from being able to use their currency sovereignty to develop their own economies.

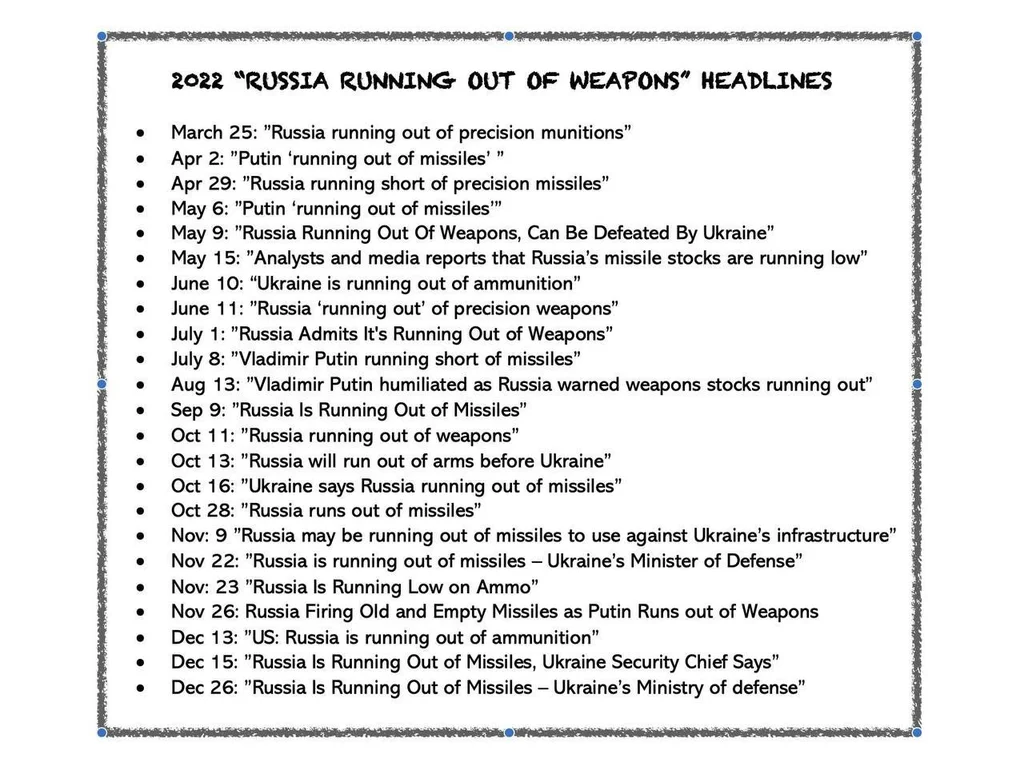

It's true that by the logic of MMT, a country with all of the resources it needs within its own borders (== within the boundaries of its monopoly on violence == within the region it can enact taxes on) can print however much money it needs to mobilize fallow resources (or until 100% employment is reached) while ignoring the effects on its currency's exchange rate, precisely because it doesn't need to obtain resources through trade - exactly as was seen in the USSR under Stalin and, as a shadow of that, Russia after 2022. The sanctions applied to Russia "should" have collapsed it, because most other countries in the world would have collapsed under this sanctions regime, but unlike those countries Russia is capable of producing all its own food, fuel and raw materials. Indeed, freezing a bunch of the oligarch's money and preventing capital flight from Russia meant rubles had to be invested in productive industries, on top of the state increasing spending on war production, which combined to give a massive boost to Russia's productive economy! However, the Russian central bank did everything in its power to prevent and undo this, because it's controlled by neoliberals, so printing money to develop the economy "doesn't work" because at every turn, neoliberals will sabotage it!

To go poking around their other tweets, here they complain about insider trading:

They say "sure would be cool if we had an agency in the government in charge of investigating insider trading", but using their logic the fact that insider trading wasn't investigated proves that it can't be - and in our currently existing political economy, they would be right! Investigating insider trading is specifically against the financial interests of the groups that hold political power over this economy, so it is impossible to investigate insider trading in the same way it's impossible to implement the recommendations of MMT for building a productive economy. But that doesn't mean that 'investigating insider trading' as an activity can never occur, the same way it doesn't mean that MMT is incorrect.

They also have a tweet that seems to be implying an MMT researcher is racist because they refer to "yellow dollars" in the context of Chinese dollar holdings...

...rather than understanding that "green dollars" - the kind of money you keep in your pocket in real life - and "yellow dollars" - US treasury bills - are called that because of the color of the paper they're printed on?? That seems like a pretty important feature of the dollar economy to be completely unaware of!

Russia, take my energy!

Russia, take my energy!

Good to see inflammatory speech getting an inflammatory response